Global digestive health products market is expected to reach USD 59.3 Billion by 2025 at a CAGR of 8.4% during the forecast period from 2018-2025. Increasing demand for nutritional & fortifying food additives and growing issues about gut health are two main factors affecting the growth.

Market Overview:

Digestive health products are those type of products which intends to perk up the working of the digestive tract of the human beings. Various elements of the digestive tract need important care as a result of their delicate nature. So, maintaining the health with the utilization of digestive health products has surfaced as a key healthcare trend in several regions around the globe. Digestive health products are produced mainly to uphold healthy levels of acid in the stomach and reloading healthy gut bacteria that carry out a critical part in absorption and digestion of all the nutrients existing in the food.

Report Description:

Market Dynamics:

Drivers:

Restraints:

Opportunities:

Challenges:

Global Digestive Health Products Market Key Findings:

All the segments have been analysed on global, regional and country basis. The study includes the analysis of more than 30 countries for each segment.

Segmentation Analysis:

The digestive health products market is segmented on the basis of ingredients, sales channel and product type.

Regional Segmentation Analysis:

The regions analysed for the market include North America, Europe, South America, Asia Pacific, and Middle East and Africa. North America region dominated the global digestive health products market with USD 12.97 Billion in 2017 where as the Asia Pacific rapidly growing region in the market.

Global Digestive Health Products Market Competitive Analysis:

Key players in the digestive health products market are Chr. Hansen Holding, Nestle SA, E. I. DuPont Nemours and Company, Yakult Honsha Co. Ltd., and Danone SA., Arla Foods Inc., Cargill Inc., Mondelez International Inc., PepsiCo Inc, and General Mills. For instance, Kellogg introduced a new cereal called HI! Happy Inside featuring prebiotics, probiotics and fiber. The Michigan-based CPG company said its new product makes digestive wellness support easily accessible.

*All our reports are customizable as per customer requirements

This study forecasts revenue growth and volume at global, regional, and country levels from 2015 to 2025. Fior Market Research has segmented the global digestive health products market on the basis of below mentioned segments:

Global Digestive Health Products Market, By Ingredients:

Global Digestive Health Products Market, By Product Type:

Global Digestive Health Products Market, By Sales Channel:

Global Digestive Health Products Market, By Regions:

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis By Ingredients

4.3.2. Market Attractiveness Analysis By Product Type

4.3.3. Market Attractiveness Analysis By Sales Channel

4.3.4. Market Attractiveness Analysis By Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. Rising demand for nutritional & fortifying food additives

5.2.2. Increasing issues about gut health

5.2.3. Growing awareness among the population related to the importance of digestive health

5.3. Restraints

5.3.1. High cost of ingredient development

5.4. Opportunities

5.4.1. Developing countries to provide significant growth opportunities

5.5. Challenges

5.5.1. Stringent government regulations

6. Global Digestive Health Products Market Analysis and Forecast, By Ingredients

6.1. Segment Overview

6.2. Probiotics

6.3. Prebiotics

6.4. Food Enzymes

6.4.1. Animal-based

6.4.2. Plant-based

6.4.3. Microbial-based

7. Global Digestive Health Products Market Analysis and Forecast, By Product Type

7.1. Segment Overview

7.2. Dairy Products

7.3. Bakery Products and Cereals

7.4. Non-alcoholic Beverages

8. Global Digestive Health Products Market Analysis and Forecast, By Sales Channel

8.1. Segment Overview

8.2. Modern Trade

8.3. Convenience Stores

8.4. Online Retailers

9. Global Digestive Health Products Market Analysis and Forecast, By Regional Analysis

9.1. Segment Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.2.3. Mexico

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. Sweden

9.3.4. Netherlands

9.3.5. U.K.

9.3.6. Italy

9.3.7. Spain

9.3.8. Turkey

9.3.9. Switzerland

9.3.10. Belgium

9.3.11. Rest of Europe

9.4. Asia-Pacific

9.4.1. Japan

9.4.2. China

9.4.3. India

9.4.4. South Korea

9.4.5. Australia

9.4.6. Singapore

9.4.7. Malaysia

9.4.8. Thailand

9.4.9. Indonesia

9.4.10. Philippines

9.4.11. Rest of Asia-Pacific

9.5. South America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Rest of South America

9.6. Middle East and Africa

9.6.1. Saudi Arabia

9.6.2. UAE

9.6.3. Egypt

9.6.4. Nigeria

9.6.5. South Africa

9.6.6. Rest of Middle East and Africa

10. Global Digestive Health Products Market-Competitive Landscape

10.1. Overview

10.2. Market Share of Key Players in the Digestive Health Products Market

10.2.1. Global Company Market Share

10.2.2. North America Company Market Share

10.2.3. Europe Company Market Share

10.2.4. APAC Company Market Share

10.3. Competitive Situations and Trends

10.3.1. Product Type Launches and Developments

10.3.2. Partnerships, Collaborations, and Agreements

10.3.3. Mergers & Acquisitions

10.3.4. Expansions

11. Company Profiles

11.1. Chr. Hansen Holding

11.1.1. Business Overview

11.1.2. Company Snapshot

11.1.3. Company Market Share Analysis

11.1.4. Company Product Portfolio

11.1.5. Recent Developments

11.1.6. SWOT Analysis

11.2. Nestle SA

11.2.1. Business Overview

11.2.2. Company Snapshot

11.2.3. Company Market Share Analysis

11.2.4. Company Product Portfolio

11.2.5. Recent Developments

11.2.6. SWOT Analysis

11.3. E. I. DuPont Nemours and Company

11.3.1. Business Overview

11.3.2. Company Snapshot

11.3.3. Company Market Share Analysis

11.3.4. Company Product Portfolio

11.3.5. Recent Developments

11.3.6. SWOT Analysis

11.4. Yakult Honsha Co. Ltd

11.4.1. Business Overview

11.4.2. Company Snapshot

11.4.3. Company Market Share Analysis

11.4.4. Company Product Portfolio

11.4.5. Recent Developments

11.4.6. SWOT Analysis

11.5. Danone SA.

11.5.1. Business Overview

11.5.2. Company Snapshot

11.5.3. Company Market Share Analysis

11.5.4. Company Product Portfolio

11.5.5. Recent Developments

11.5.6. SWOT Analysis

11.6. Arla Foods Inc

11.6.1. Business Overview

11.6.2. Company Snapshot

11.6.3. Company Market Share Analysis

11.6.4. Company Product Portfolio

11.6.5. Recent Developments

11.6.6. SWOT Analysis

11.7. Cargill Inc

11.7.1. Business Overview

11.7.2. Company Snapshot

11.7.3. Company Market Share Analysis

11.7.4. Company Product Portfolio

11.7.5. Recent Developments

11.7.6. SWOT Analysis

11.8. Mondelez International Inc

11.8.1. Business Overview

11.8.2. Company Snapshot

11.8.3. Company Market Share Analysis

11.8.4. Company Product Portfolio

11.8.5. Recent Developments

11.8.6. SWOT Analysis

11.9. PepsiCo Inc

11.9.1. Business Overview

11.9.2. Company Snapshot

11.9.3. Company Market Share Analysis

11.9.4. Company Product Portfolio

11.9.5. Recent Developments

11.9.6. SWOT Analysis

11.10. General Mills

11.10.1. Business Overview

11.10.2. Company Snapshot

11.10.3. Company Market Share Analysis

11.10.4. Company Product Portfolio

11.10.5. Recent Developments

11.10.6. SWOT Analysis

11.11. Alimentary Health Limited

11.11.1. Business Overview

11.11.2. Company Snapshot

11.11.3. Company Market Share Analysis

11.11.4. Company Product Portfolio

11.11.5. Recent Developments

11.11.6. SWOT Analysis

11.12. Nutrica NV

11.12.1. Business Overview

11.12.2. Company Snapshot

11.12.3. Company Market Share Analysis

11.12.4. Company Product Portfolio

11.12.5. Recent Developments

11.12.6. SWOT Analysis

11.13. Hamari Chemicals LTD

11.13.1. Business Overview

11.13.2. Company Snapshot

11.13.3. Company Market Share Analysis

11.13.4. Company Product Portfolio

11.13.5. Recent Developments

11.13.6. SWOT Analysis

11.14. Lonza Group Ltd

11.14.1. Business Overview

11.14.2. Company Snapshot

11.14.3. Company Market Share Analysis

11.14.4. Company Product Portfolio

11.14.5. Recent Developments

11.14.6. SWOT Analysis

11.15. Nestec SA

11.15.1. Business Overview

11.15.2. Company Snapshot

11.15.3. Company Market Share Analysis

11.15.4. Company Product Portfolio

11.15.5. Recent Developments

11.15.6. SWOT Analysis

List of Figures

1. Global Digestive Health Products Market Segmentation

2. Digestive Health Products Market: Research Methodology

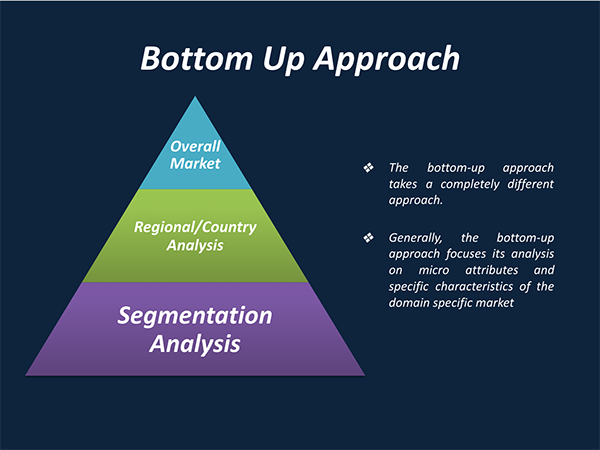

3. Market Size Estimation Methodology: Bottom-Up Approach

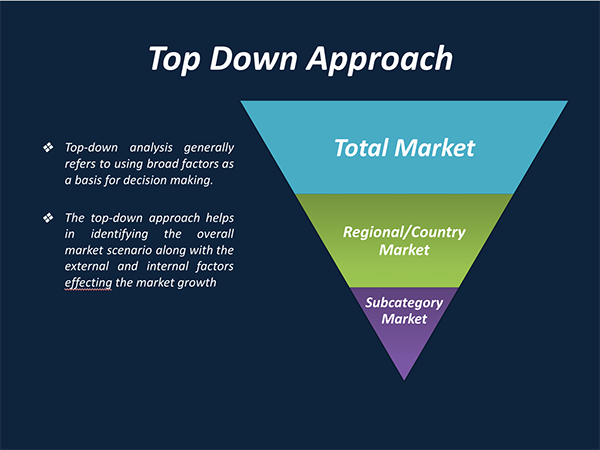

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Digestive Health Products Market Attractiveness Analysis By Ingredients

9. Global Digestive Health Products Market Attractiveness Analysis By Product Type

10. Global Digestive Health Products Market Attractiveness Analysis By Sales Channel

11. Global Digestive Health Products Market Attractiveness Analysis By Region

12. Global Digestive Health Products Market: Dynamics

13. Global Digestive Health Products Market Share by Ingredients (2017 & 2025)

14. Global Digestive Health Products Market Share by Product Type (2017 & 2025)

15. Global Digestive Health Products Market Share by Sales Channel (2017 & 2025)

16. Global Digestive Health Products Market Share by Region (2017 & 2025)

17. Global Digestive Health Products Market Share by Company (2018)

List of Table

1. Global Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

2. Global Digestive Health Products Market, By Food Enzymes, 2015–2025 (USD Billion) (Tonnes)

3. Global Probiotics Digestive Health Products Market, By Region, 2015–2025 (USD Billion) (Tonnes)

4. Global Prebiotics Digestive Health Products Market, By Region, 2015–2025 (USD Billion) (Tonnes)

5. Global Food Enzymes Digestive Health Products Market, By Region, 2015–2025 (USD Billion) (Tonnes)

6. Global Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

7. Global Dairy Products Digestive Health Products Market, By Region, 2015–2025 (USD Billion) (Tonnes)

8. Global Bakery Products and Cereals Digestive Health Products Market, By Region, 2015–2025 (USD Billion) (Tonnes)

9. Global Non-alcoholic Beverages Digestive Health Products Market, By Region, 2015–2025 (USD Billion) (Tonnes)

10. Global Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

11. Global Modern Trade Digestive Health Products Market, By Region, 2015–2025 (USD Billion) (Tonnes)

12. Global Convenience Stores Digestive Health Products Market, By Region, 2015–2025 (USD Billion) (Tonnes)

13. Global Online Retailers Digestive Health Products Market, By Region, 2015–2025 (USD Billion) (Tonnes)

14. Global Digestive Health Products Market, By Region, 2015–2025 (USD Billion) (Tonnes)

15. North America Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

16. North America Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

17. North America Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

18. U.S. Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

19. U.S. Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

20. U.S. Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

21. Canada Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

22. Canada Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

23. Canada Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

24. Mexico Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

25. Mexico Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

26. Mexico Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

27. Europe Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

28. Europe Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

29. Europe Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

30. Germany Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

31. Germany Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

32. Germany Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

33. France Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

34. France Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

35. France Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

36. Sweden Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

37. Sweden Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

38. Sweden Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

39. Netherlands Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

40. Netherlands Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

41. Netherlands Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

42. U.K. Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

43. U.K. Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

44. U.K. Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

45. Italy Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

46. Italy Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

47. Italy Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

48. Spain Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

49. Spain Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

50. Spain Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

51. Turkey Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

52. Turkey Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

53. Turkey Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

54. Switzerland Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

55. Switzerland Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

56. Switzerland Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

57. Belgium Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

58. Belgium Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

59. Belgium Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

60. Asia Pacific Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

61. Asia Pacific Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

62. Asia Pacific Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

63. Japan Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

64. Japan Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

65. Japan Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

66. China Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

67. China Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

68. China Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

69. India Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

70. India Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

71. India Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

72. South Korea Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

73. South Korea Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

74. South Korea Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

75. Australia Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

76. Australia Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

77. Australia Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

78. Singapore Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

79. Singapore Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

80. Singapore Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

81. Malaysia Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

82. Malaysia Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

83. Malaysia Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

84. Thailand Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

85. Thailand Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

86. Thailand Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

87. Indonesia Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

88. Indonesia Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

89. Indonesia Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

90. Philippines Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

91. Philippines Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

92. Philippines Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

93. South America Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

94. South America Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

95. South America Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

96. Brazil Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

97. Brazil Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

98. Brazil Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

99. Argentina Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

100. Argentina Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

101. Argentina Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

102. Colombia Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

103. Colombia Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

104. Colombia Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

105. Middle East and Africa Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

106. Middle East and Africa Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

107. Middle East and Africa Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

108. Saudi Arabia Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

109. Saudi Arabia Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

110. Saudi Arabia Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

111. UAE Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

112. UAE Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

113. UAE Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

114. Egypt Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

115. Egypt Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

116. Egypt Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

117. Nigeria Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

118. Nigeria Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

119. Nigeria Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

120. South Africa Digestive Health Products Market, By Ingredients, 2015–2025 (USD Billion) (Tonnes)

121. South Africa Digestive Health Products Market, By Product Type, 2015–2025 (USD Billion) (Tonnes)

122. South Africa Digestive Health Products Market, By Sales Channel, 2015–2025 (USD Billion) (Tonnes)

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

Our market research process involves with the four specific stages.

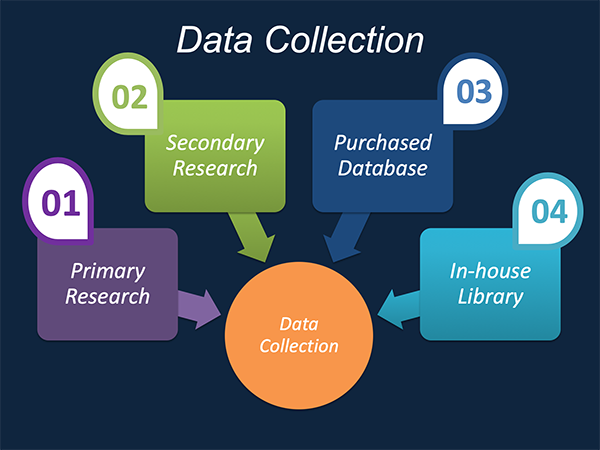

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.