The cash flow management market is expected to grow USD 4429.53 million in 2020 to USD 18668.56 million by 2028, at a CAGR of 19.7% during the forecast period 2021-2028.

Cash flow is the process of analyzing, optimizing, & monitoring the net amount of cash. The cash flow controls the outflow & inflow of funds that determine a business's solvency. Cash management is the method of managing & collecting cash flows. Cash management can be important for both individuals & companies. Cash flow is a marketing term for certain services associated with cash flow, proposed initially to more leading enterprise customers.

The factors driving the market are the growing adoption of predictive analytics over industries, increasing demand for cash flow analysis, cash flow management for improving the planning and budgeting cycles, and forecasting due to rapid business development. The factors restraining the market growth are the increase in government initiatives to promote a cashless economy and an increase in new regulations & financial standards. Integrating artificial intelligence (AI) & machine learning (ML) techniques in the financial sector provides market growth opportunities.

This study delivers a comprehensive analysis of organization size, component deployment, vertical, and region.The organization size segment includeslarge enterprises and SMEs. The large enterprise organization size segment held the largest market share in the year 2020, owing to the rising adoption of cash flow management solutions in large banks to maintain petty cash & bank account balances quickly & easily. These systems incorporate an image lockbox, automated clearing house (ACH) receipt, and other payable mechanization services. The cash management solutions allow depository management teams to maintain their payment processes seamlessly & aid make efficient financial decisions & decrease overhead prices. The component segment includes services and solution. The solution segment holds the largest market share in the year 2020, owing to the growing requirement for fund transfer process streamlining & mechanization of money management processes. The cash management solutions allow companies to simplify complicated money shift methods & decrease manual workload. The deployment segment includes on-premises & cloud. The cloud segment holds the largest market share in the year 2020, owing to the progress in technology & various benefits it offers like low operational cost and easy up-gradation. The advantage of this deployment process is that companies utilizing cloud services need not upgrade those services constantly. Furthermore, this deployment allows the capability to control, manage, and monitor large & complicated systems. The vertical segment includes BFSI, transportation, IT &ITeS, government, retail, manufacturing, healthcare, others. The IT &ITeS segment holds the largest market share in the year 2020, owing to the increasing number of companies in these enterprises. Moreover, the IT &ITes vertical has witnessed rapid growth throughout the past decade, undergoing multiple changes. Among its disparate spending, an interdependency of services, enormous size, and the vertical displays complex contracts and minimal resources & time. The cash flow management solutions can assist these companies in overcoming such difficulties by advanced cash flow forecasting abilities. These solutions significantly support the businesses in identifying the potential threats predominating in the vertical to bypass losses.

The market has been divided into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. North America holds the largest market share in the global market, owing to the appearance of trending technologies like data analytics, and BI, AI, ML. Businesses in this region are adopting cash flow management services and software to future-proof their companies. The Asia Pacific is expected to witness significant growth due to the rising cash flow management demand.

Some of the notable players in the market areCaflou, PlanGuru, Apruve, Cash Application Cloud, Float, ABM Cashflow,CashAnalytics, Pulse, HighRadius Fluidly, and Scoro.

Cash Flow Management Market Analysis and Forecast, Organization Size

Cash Flow Management Market Analysis and Forecast, Component

Cash Flow Management Market Analysis and Forecast, Deployment

Cash Flow Management Market Analysis and Forecast, Vertical

Cash Flow Management Market Analysis and Forecast, Region

Report Description:

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis By Organization Size

4.3.2. Market Attractiveness Analysis By Component

4.3.3. Market Attractiveness Analysis By Deployment

4.3.4. Market Attractiveness Analysis By Vertical

4.3.5. Market Attractiveness Analysis By Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. Growing adoption of predictive analytics over industries

5.2.2. Increasing demand for cash flow analysis

5.3. Restraints

5.3.1. Increase in transportation initiatives to promote a cashless economy

5.4. Opportunities

5.4.1. Integrating artificial intelligence (AI) & machine learning (ML) techniques in the financial sector.

6. Global Cash Flow Management Market Analysis and Forecast, By Organization Size

6.1. Segment Overview

6.2. Large Enterprises

6.3. SMEs

7. Global Cash Flow Management Market Analysis and Forecast, By Component

7.1. Segment Overview

7.2. Services

7.3. Solution

8. Global Cash Flow Management Market Analysis and Forecast, By Deployment

8.1. Segment Overview

8.2. On-Premises

8.3. Cloud

9. Global Cash Flow Management Market Analysis and Forecast, By Vertical

9.1. Segment Overview

9.2. BFSI

9.3. Transportation

9.4. IT &ITeS

9.5. Government

9.6. Retail

9.7. Manufacturing

9.8. Healthcare

9.9. Others

10. Global Cash Flow Management Market Analysis and Forecast, By Regional Analysis

10.1. Segment Overview

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.2.3. Mexico

10.3. Europe

10.3.1. Germany

10.3.2. France

10.3.3. U.K.

10.3.4. Italy

10.3.5. Spain

10.4. Asia-Pacific

10.4.1. Japan

10.4.2. China

10.4.3. India

10.5. South America

10.5.1. Brazil

10.6. Middle East and Africa

10.6.1. UAE

10.6.2. South Africa

11. Global Cash Flow Management Market-Competitive Landscape

11.1. Overview

11.2. Market Share of Key Players in Global Cash Flow Management Market

11.2.1. Global Company Market Share

11.2.2. North America Company Market Share

11.2.3. Europe Company Market Share

11.2.4. APAC Company Market Share

11.3. Competitive Situations and Trends

11.3.1. Product Launches and Developments

11.3.2. Partnerships, Collaborations, and Agreements

11.3.3. Mergers & Acquisitions

11.3.4. Expansions

12. Company Profiles

12.1. Caflou

12.1.1. Business Overview

12.1.2. Company Snapshot

12.1.3. Company Market Share Analysis

12.1.4. Company Product Portfolio

12.1.5. Recent Developments

12.1.6. SWOT Analysis

12.2. Apruve

12.2.1. Business Overview

12.2.2. Company Snapshot

12.2.3. Company Market Share Analysis

12.2.4. Company Product Portfolio

12.2.5. Recent Developments

12.2.6. SWOT Analysis

12.3. Cash Application Cloud

12.3.1. Business Overview

12.3.2. Company Snapshot

12.3.3. Company Market Share Analysis

12.3.4. Company Product Portfolio

12.3.5. Recent Developments

12.3.6. SWOT Analysis

12.4. Float

12.4.1. Business Overview

12.4.2. Company Snapshot

12.4.3. Company Market Share Analysis

12.4.4. Company Product Portfolio

12.4.5. Recent Developments

12.4.6. SWOT Analysis

12.5. ABM Cashflow

12.5.1. Business Overview

12.5.2. Company Snapshot

12.5.3. Company Market Share Analysis

12.5.4. Company Product Portfolio

12.5.5. Recent Developments

12.5.6. SWOT Analysis

12.6. CashAnalytics

12.6.1. Business Overview

12.6.2. Company Snapshot

12.6.3. Company Market Share Analysis

12.6.4. Company Product Portfolio

12.6.5. Recent Developments

12.6.6. SWOT Analysis

12.7. Pulse

12.7.1. Business Overview

12.7.2. Company Snapshot

12.7.3. Company Market Share Analysis

12.7.4. Company Product Portfolio

12.7.5. Recent Developments

12.7.6. SWOT Analysis

12.8. HighRadius Fluidly

12.8.1. Business Overview

12.8.2. Company Snapshot

12.8.3. Company Market Share Analysis

12.8.4. Company Product Portfolio

12.8.5. Recent Developments

12.8.6. SWOT Analysis

12.9. Scoro

12.9.1. Business Overview

12.9.2. Company Snapshot

12.9.3. Company Market Share Analysis

12.9.4. Company Product Portfolio

12.9.5. Recent Developments

12.9.6. SWOT Analysis

List of Table

1. Global Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

2. Global Large Enterprises, Cash Flow Management Market, By Region, 2021-2028 (USD Million)

3. Global SMEs, Cash Flow Management Market, By Region, 2021-2028 (USD Million)

4. Global Cash Flow Management Market, By Component, 2021-2028 (USD Million)

5. Global Services, Cash Flow Management Market, By Region, 2021-2028 (USD Million)

6. Global Solution, Cash Flow Management Market, By Region, 2021-2028 (USD Million)

7. Global Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

8. GlobalOn-Premises, Cash Flow Management Market, By Region, 2021-2028 (USD Million)

9. Global Cloud, Cash Flow Management Market, By Region, 2021-2028 (USD Million)

10. Global Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

11. Global BFSI, Cash Flow Management Market, By Region, 2021-2028 (USD Million)

12. Global Transportation, Cash Flow Management Market, By Region, 2021-2028 (USD Million)

13. Global IT &ITeS, Cash Flow Management Market, By Region, 2021-2028 (USD Million)

14. Global Government, Cash Flow Management Market, By Region, 2021-2028 (USD Million)

15. Global Retail, Cash Flow Management Market, By Region, 2021-2028 (USD Million)

16. Global Manufacturing, Cash Flow Management Market, By Region, 2021-2028 (USD Million)

17. Global Healthcare, Cash Flow Management Market, By Region, 2021-2028 (USD Million)

18. Global Others, Cash Flow Management Market, By Region, 2021-2028 (USD Million)

19. North America Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

20. North America Cash Flow Management Market, By Component, 2021-2028 (USD Million)

21. North America Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

22. North America Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

23. U.S. Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

24. U.S. Cash Flow Management Market, By Component, 2021-2028 (USD Million)

25. U.S. Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

26. U.S. Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

27. Canada Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

28. Canada Cash Flow Management Market, By Component, 2021-2028 (USD Million)

29. Canada Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

30. Canada Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

31. Mexico Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

32. Mexico Cash Flow Management Market, By Component, 2021-2028 (USD Million)

33. Mexico Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

34. Mexico Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

35. Europe Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

36. Europe Cash Flow Management Market, By Component, 2021-2028 (USD Million)

37. Europe Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

38. Europe Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

39. Germany Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

40. Germany Cash Flow Management Market, By Component, 2021-2028 (USD Million)

41. Germany Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

42. Germany Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

43. France Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

44. France Cash Flow Management Market, By Component, 2021-2028 (USD Million)

45. France Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

46. France Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

47. U.K. Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

48. U.K. Cash Flow Management Market, By Component, 2021-2028 (USD Million)

49. U.K. Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

50. U.K. Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

51. Italy Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

52. Italy Cash Flow Management Market, By Component, 2021-2028 (USD Million)

53. Italy Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

54. Italy Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

55. Spain Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

56. Spain Cash Flow Management Market, By Component, 2021-2028 (USD Million)

57. Spain Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

58. Spain Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

59. Asia Pacific Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

60. Asia Pacific Cash Flow Management Market, By Component, 2021-2028 (USD Million)

61. Asia Pacific Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

62. Asia Pacific Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

63. Japan Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

64. Japan Cash Flow Management Market, By Component, 2021-2028 (USD Million)

65. Japan Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

66. Japan Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

67. China Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

68. China Cash Flow Management Market, By Component, 2021-2028 (USD Million)

69. China Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

70. China Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

71. India Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

72. India Cash Flow Management Market, By Component, 2021-2028 (USD Million)

73. India Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

74. India Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

75. South America Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

76. South America Cash Flow Management Market, By Component, 2021-2028 (USD Million)

77. South America Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

78. South America Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

79. Brazil Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

80. Brazil Cash Flow Management Market, By Component, 2021-2028 (USD Million)

81. Brazil Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

82. Brazil Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

83. Middle East and Africa Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

84. Middle East and Africa Cash Flow Management Market, By Component, 2021-2028 (USD Million)

85. Middle East and Africa Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

86. Middle East and Africa Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

87. UAE Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

88. UAE Cash Flow Management Market, By Component, 2021-2028 (USD Million)

89. UAE Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

90. UAE Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

91. South Africa Cash Flow Management Market, By Organization Size, 2021-2028 (USD Million)

92. South Africa Cash Flow Management Market, By Component, 2021-2028 (USD Million)

93. South Africa Cash Flow Management Market, By Deployment, 2021-2028 (USD Million)

94. South Africa Cash Flow Management Market, By Vertical, 2021-2028 (USD Million)

List of Figures

1. Global Cash Flow Management Market Segmentation

2. Global Cash Flow Management Market: Research Methodology

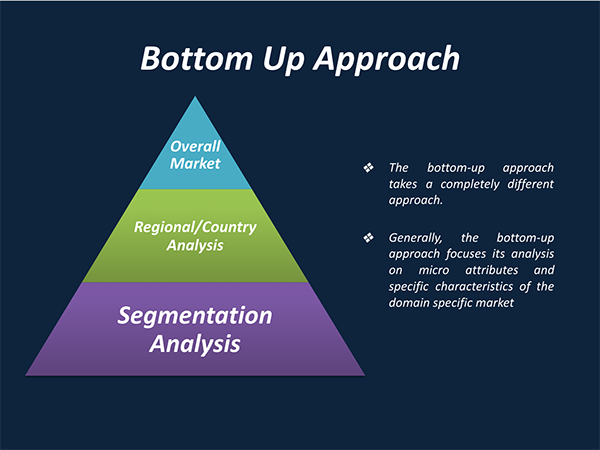

3. Market Size Estimation Methodology: Bottom-Up Approach

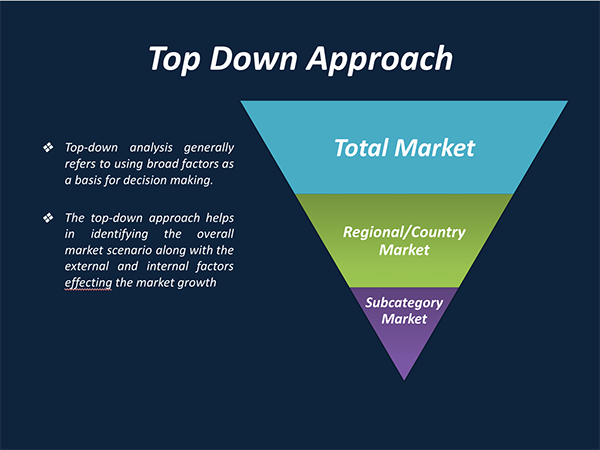

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Cash Flow Management Market Attractiveness Analysis By Organization Size

9. Global Cash Flow Management Market Attractiveness Analysis By Component

10. Global Cash Flow Management Market Attractiveness Analysis By Deployment

11. Global Cash Flow Management Market Attractiveness Analysis By Vertical

12. Global Cash Flow Management Market Attractiveness Analysis By Region

13. Global Cash Flow Management Market: Dynamics

14. Global Cash Flow Management Market Share By Organization Size(2021 & 2028)

15. Global Cash Flow Management Market Share by Component (2021 & 2028)

16. Global Cash Flow Management Market Share by Deployment (2021 & 2028)

17. Global Cash Flow Management Market Share by Vertical (2021 & 2028)

18. Global Cash Flow Management Market Share by Regions (2021 & 2028)

19. Global Cash Flow Management Market Share by Company (2020)

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

Our market research process involves with the four specific stages.

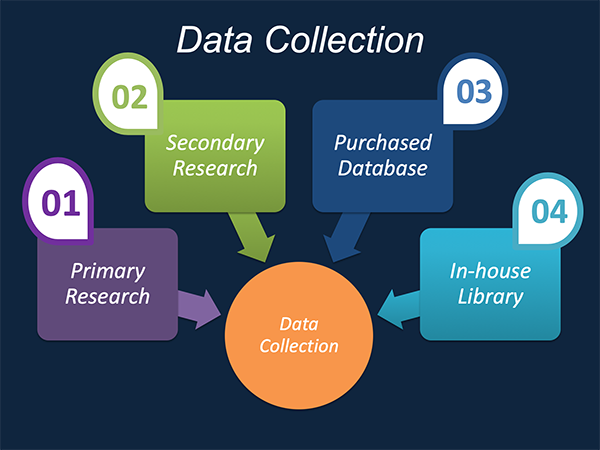

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.