Market Overview

The global Industrial Used Audible & Visual Signaling Devices market size is expected to gain market growth in the forecast period of 2020 to 2025, with a CAGR of 3.9% in the forecast period of 2020 to 2025 and will expected to reach USD 831.7 million by 2025, from USD 714.1 million in 2019.

The Industrial Used Audible & Visual Signaling Devices market report provides a detailed analysis of global market size, regional and country-level market size, segmentation market growth, market share, competitive Landscape, sales analysis, impact of domestic and global market players, value chain optimization, trade regulations, recent developments, opportunities analysis, strategic market growth analysis, product launches, area marketplace expanding, and technological innovations.

Market segmentation

Industrial Used Audible & Visual Signaling Devices market is split by Type and by Application. For the period 2015-2025, the growth among segments provide accurate calculations and forecasts for sales by Type and by Application in terms of volume and value. This analysis can help you expand your business by targeting qualified niche markets.

By Type, Industrial Used Audible & Visual Signaling Devices market has been segmented into

Strobe and Beacons

Signal Towers

Bells and Horns

Fire Alarm/Call Points

Speakers and Tone Generators

Visual & Audible Combination Units

By Application, Industrial Used Audible & Visual Signaling Devices has been segmented into:

Oil and Gas

Chemical and Pharmaceutical

Food and Beverages

Energy and Power

Mining

Others

Regions and Countries Level Analysis

Regional analysis is another highly comprehensive part of the research and analysis study of the global Industrial Used Audible & Visual Signaling Devices market presented in the report. This section sheds light on the sales growth of different regional and country-level Industrial Used Audible & Visual Signaling Devices markets. For the historical and forecast period 2015 to 2025, it provides detailed and accurate country-wise volume analysis and region-wise market size analysis of the global Industrial Used Audible & Visual Signaling Devices market.

The report offers in-depth assessment of the growth and other aspects of the Industrial Used Audible & Visual Signaling Devices market in important countries (regions), including:

North America (United States, Canada and Mexico)

Europe (Germany, France, UK, Russia and Italy)

Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

South America (Brazil, Argentina, etc.)

Middle East & Africa (Saudi Arabia, Egypt, Nigeria and South Africa)

Competitive Landscape and Industrial Used Audible & Visual Signaling Devices Market Share Analysis

Industrial Used Audible & Visual Signaling Devices competitive landscape provides details by vendors, including company overview, company total revenue (financials), market potential, global presence, Industrial Used Audible & Visual Signaling Devices sales and revenue generated, market share, price, production sites and facilities, SWOT analysis, product launch. For the period 2015-2020, this study provides the Industrial Used Audible & Visual Signaling Devices sales, revenue and market share for each player covered in this report.

The major players covered in Industrial Used Audible & Visual Signaling Devices are:

Patlite Corporation

Schneider Electric

Eaton Corporation PLC (Cooper Industries)

Federal Signal Corporation

Honeywell (Novar GmbH)

Werma Signaltechnik GmbH

Auer Signal

Potter Electric Signal Company, LLC

Rockwell Automation, Inc.

R. Stahl AG

Sirena S.p.A.

E2S Warning Signals

Pfannenberg

Tomar Electronics, Inc

Moflash Signalling Ltd

Among other players domestic and global, Industrial Used Audible & Visual Signaling Devices market share data is available for global, North America, Europe, Asia-Pacific, Middle East and Africa and South America separately. Our analysts understand competitive strengths and provide competitive analysis for each competitor separately.

The content of the study subjects, includes a total of 15 chapters:

Chapter 1, to describe Industrial Used Audible & Visual Signaling Devices product scope, market overview, market opportunities, market driving force and market risks.

Chapter 2, to profile the top manufacturers of Industrial Used Audible & Visual Signaling Devices, with price, sales, revenue and global market share of Industrial Used Audible & Visual Signaling Devices in 2018 and 2019.

Chapter 3, the Industrial Used Audible & Visual Signaling Devices competitive situation, sales, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast.

Chapter 4, the Industrial Used Audible & Visual Signaling Devices breakdown data are shown at the regional level, to show the sales, revenue and growth by regions, from 2015 to 2020.

Chapter 5, 6, 7, 8 and 9, to break the sales data at the country level, with sales, revenue and market share for key countries in the world, from 2015 to 2020.

Chapter 10 and 11, to segment the sales by type and application, with sales market share and growth rate by type, application, from 2015 to 2020.

Chapter 12, Industrial Used Audible & Visual Signaling Devices market forecast, by regions, type and application, with sales and revenue, from 2020 to 2025.

Chapter 13, 14 and 15, to describe Industrial Used Audible & Visual Signaling Devices sales channel, distributors, customers, research findings and conclusion, appendix and data source.

Table of Contents

1 Market Overview

1.1 Industrial Used Audible & Visual Signaling Devices Introduction

1.2 Market Analysis by Type

1.2.1 Overview: Global Industrial Used Audible & Visual Signaling Devices Revenue by Type: 2015 VS 2019 VS 2025

1.2.2 Strobe and Beacons

1.2.3 Signal Towers

1.2.4 Bells and Horns

1.2.5 Fire Alarm/Call Points

1.2.6 Speakers and Tone Generators

1.2.7 Visual & Audible Combination Units

1.3 Market Analysis by Application

1.3.1 Overview: Global Industrial Used Audible & Visual Signaling Devices Revenue by Application: 2015 VS 2019 VS 2025

1.3.2 Oil and Gas

1.3.3 Chemical and Pharmaceutical

1.3.4 Food and Beverages

1.3.5 Energy and Power

1.3.6 Mining

1.3.7 Others

1.4 Overview of Global Industrial Used Audible & Visual Signaling Devices Market

1.4.1 Global Industrial Used Audible & Visual Signaling Devices Market Status and Outlook (2015-2025)

1.4.2 North America (United States, Canada and Mexico)

1.4.3 Europe (Germany, France, United Kingdom, Russia and Italy)

1.4.4 Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

1.4.5 South America, Middle East & Africa

1.5 Market Dynamics

1.5.1 Market Opportunities

1.5.2 Market Risk

1.5.3 Market Driving Force

2 Manufacturers Profiles

2.1 Patlite Corporation

2.1.1 Patlite Corporation Details

2.1.2 Patlite Corporation Major Business and Total Revenue (Financial Highlights) Analysis

2.1.3 Patlite Corporation SWOT Analysis

2.1.4 Patlite Corporation Product and Services

2.1.5 Patlite Corporation Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

2.2 Schneider Electric

2.2.1 Schneider Electric Details

2.2.2 Schneider Electric Major Business and Total Revenue (Financial Highlights) Analysis

2.2.3 Schneider Electric SWOT Analysis

2.2.4 Schneider Electric Product and Services

2.2.5 Schneider Electric Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

2.3 Eaton Corporation PLC (Cooper Industries)

2.3.1 Eaton Corporation PLC (Cooper Industries) Details

2.3.2 Eaton Corporation PLC (Cooper Industries) Major Business and Total Revenue (Financial Highlights) Analysis

2.3.3 Eaton Corporation PLC (Cooper Industries) SWOT Analysis

2.3.4 Eaton Corporation PLC (Cooper Industries) Product and Services

2.3.5 Eaton Corporation PLC (Cooper Industries) Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

2.4 Federal Signal Corporation

2.4.1 Federal Signal Corporation Details

2.4.2 Federal Signal Corporation Major Business and Total Revenue (Financial Highlights) Analysis

2.4.3 Federal Signal Corporation SWOT Analysis

2.4.4 Federal Signal Corporation Product and Services

2.4.5 Federal Signal Corporation Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

2.5 Honeywell (Novar GmbH)

2.5.1 Honeywell (Novar GmbH) Details

2.5.2 Honeywell (Novar GmbH) Major Business and Total Revenue (Financial Highlights) Analysis

2.5.3 Honeywell (Novar GmbH) SWOT Analysis

2.5.4 Honeywell (Novar GmbH) Product and Services

2.5.5 Honeywell (Novar GmbH) Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

2.6 Werma Signaltechnik GmbH

2.6.1 Werma Signaltechnik GmbH Details

2.6.2 Werma Signaltechnik GmbH Major Business and Total Revenue (Financial Highlights) Analysis

2.6.3 Werma Signaltechnik GmbH SWOT Analysis

2.6.4 Werma Signaltechnik GmbH Product and Services

2.6.5 Werma Signaltechnik GmbH Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

2.7 Auer Signal

2.7.1 Auer Signal Details

2.7.2 Auer Signal Major Business and Total Revenue (Financial Highlights) Analysis

2.7.3 Auer Signal SWOT Analysis

2.7.4 Auer Signal Product and Services

2.7.5 Auer Signal Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

2.8 Potter Electric Signal Company, LLC

2.8.1 Potter Electric Signal Company, LLC Details

2.8.2 Potter Electric Signal Company, LLC Major Business and Total Revenue (Financial Highlights) Analysis

2.8.3 Potter Electric Signal Company, LLC SWOT Analysis

2.8.4 Potter Electric Signal Company, LLC Product and Services

2.8.5 Potter Electric Signal Company, LLC Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

2.9 Rockwell Automation, Inc.

2.9.1 Rockwell Automation, Inc. Details

2.9.2 Rockwell Automation, Inc. Major Business and Total Revenue (Financial Highlights) Analysis

2.9.3 Rockwell Automation, Inc. SWOT Analysis

2.9.4 Rockwell Automation, Inc. Product and Services

2.9.5 Rockwell Automation, Inc. Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

2.10 R. Stahl AG

2.10.1 R. Stahl AG Details

2.10.2 R. Stahl AG Major Business and Total Revenue (Financial Highlights) Analysis

2.10.3 R. Stahl AG SWOT Analysis

2.10.4 R. Stahl AG Product and Services

2.10.5 R. Stahl AG Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

2.11 Sirena S.p.A.

2.11.1 Sirena S.p.A. Details

2.11.2 Sirena S.p.A. Major Business and Total Revenue (Financial Highlights) Analysis

2.11.3 Sirena S.p.A. SWOT Analysis

2.11.4 Sirena S.p.A. Product and Services

2.11.5 Sirena S.p.A. Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

2.12 E2S Warning Signals

2.12.1 E2S Warning Signals Details

2.12.2 E2S Warning Signals Major Business and Total Revenue (Financial Highlights) Analysis

2.12.3 E2S Warning Signals SWOT Analysis

2.12.4 E2S Warning Signals Product and Services

2.12.5 E2S Warning Signals Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

2.13 Pfannenberg

2.13.1 Pfannenberg Details

2.13.2 Pfannenberg Major Business and Total Revenue (Financial Highlights) Analysis

2.13.3 Pfannenberg SWOT Analysis

2.13.4 Pfannenberg Product and Services

2.13.5 Pfannenberg Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

2.14 Tomar Electronics, Inc

2.14.1 Tomar Electronics, Inc Details

2.14.2 Tomar Electronics, Inc Major Business and Total Revenue (Financial Highlights) Analysis

2.14.3 Tomar Electronics, Inc SWOT Analysis

2.14.4 Tomar Electronics, Inc Product and Services

2.14.5 Tomar Electronics, Inc Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

2.15 Moflash Signalling Ltd

2.15.1 Moflash Signalling Ltd Details

2.15.2 Moflash Signalling Ltd Major Business and Total Revenue (Financial Highlights) Analysis

2.15.3 Moflash Signalling Ltd SWOT Analysis

2.15.4 Moflash Signalling Ltd Product and Services

2.15.5 Moflash Signalling Ltd Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

3 Sales, Revenue and Market Share by Manufacturer

3.1 Global Industrial Used Audible & Visual Signaling Devices Sales and Market Share by Manufacturer (2018-2019)

3.2 Global Industrial Used Audible & Visual Signaling Devices Revenue and Market Share by Manufacturer (2018-2019)

3.3 Market Concentration Rate

3.3.1 Top 3 Industrial Used Audible & Visual Signaling Devices Manufacturer Market Share in 2019

3.3.2 Top 6 Industrial Used Audible & Visual Signaling Devices Manufacturer Market Share in 2019

3.4 Market Competition Trend

4 Global Market Analysis by Regions

4.1 Global Industrial Used Audible & Visual Signaling Devices Sales, Revenue and Market Share by Regions

4.1.1 Global Industrial Used Audible & Visual Signaling Devices Sales and Market Share by Regions (2015-2020)

4.1.2 Global Industrial Used Audible & Visual Signaling Devices Revenue and Market Share by Regions (2015-2020)

4.2 North America Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

4.3 Europe Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

4.4 Asia-Pacific Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

4.5 South America Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

4.6 Middle East and Africa Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

5 North America by Country

5.1 North America Industrial Used Audible & Visual Signaling Devices Sales, Revenue and Market Share by Country

5.1.1 North America Industrial Used Audible & Visual Signaling Devices Sales and Market Share by Country (2015-2020)

5.1.2 North America Industrial Used Audible & Visual Signaling Devices Revenue and Market Share by Country (2015-2020)

5.2 United States Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

5.3 Canada Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

5.4 Mexico Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

6 Europe by Country

6.1 Europe Industrial Used Audible & Visual Signaling Devices Sales, Revenue and Market Share by Country

6.1.1 Europe Industrial Used Audible & Visual Signaling Devices Sales and Market Share by Country (2015-2020)

6.1.2 Europe Industrial Used Audible & Visual Signaling Devices Revenue and Market Share by Country (2015-2020)

6.2 Germany Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

6.3 UK Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

6.4 France Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

6.5 Russia Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

6.6 Italy Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

7 Asia-Pacific by Regions

7.1 Asia-Pacific Industrial Used Audible & Visual Signaling Devices Sales, Revenue and Market Share by Regions

7.1.1 Asia-Pacific Industrial Used Audible & Visual Signaling Devices Sales and Market Share by Regions (2015-2020)

7.1.2 Asia-Pacific Industrial Used Audible & Visual Signaling Devices Revenue and Market Share by Regions (2015-2020)

7.2 China Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

7.3 Japan Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

7.4 Korea Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

7.5 India Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

7.6 Southeast Asia Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

7.7 Australia Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

8 South America by Country

8.1 South America Industrial Used Audible & Visual Signaling Devices Sales, Revenue and Market Share by Country

8.1.1 South America Industrial Used Audible & Visual Signaling Devices Sales and Market Share by Country (2015-2020)

8.1.2 South America Industrial Used Audible & Visual Signaling Devices Revenue and Market Share by Country (2015-2020)

8.2 Brazil Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

8.3 Argentina Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

9 Middle East & Africa by Countries

9.1 Middle East & Africa Industrial Used Audible & Visual Signaling Devices Sales, Revenue and Market Share by Country

9.1.1 Middle East & Africa Industrial Used Audible & Visual Signaling Devices Sales and Market Share by Country (2015-2020)

9.1.2 Middle East & Africa Industrial Used Audible & Visual Signaling Devices Revenue and Market Share by Country (2015-2020)

9.2 Saudi Arabia Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

9.3 Turkey Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

9.4 Egypt Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

9.5 South Africa Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

10 Market Segment by Type

10.1 Global Industrial Used Audible & Visual Signaling Devices Sales and Market Share by Type (2015-2020)

10.2 Global Industrial Used Audible & Visual Signaling Devices Revenue and Market Share by Type (2015-2020)

10.3 Global Industrial Used Audible & Visual Signaling Devices Price by Type (2015-2020)

11 Global Industrial Used Audible & Visual Signaling Devices Market Segment by Application

11.1 Global Industrial Used Audible & Visual Signaling Devices Sales Market Share by Application (2015-2020)

11.2 Global Industrial Used Audible & Visual Signaling Devices Revenue Market Share by Application (2015-2020)

11.3 Global Industrial Used Audible & Visual Signaling Devices Price by Application (2015-2020)

12 Market Forecast

12.1 Global Industrial Used Audible & Visual Signaling Devices Sales, Revenue and Growth Rate (2021-2025)

12.2 Industrial Used Audible & Visual Signaling Devices Market Forecast by Regions (2021-2025)

12.2.1 North America Industrial Used Audible & Visual Signaling Devices Market Forecast (2021-2025)

12.2.2 Europe Industrial Used Audible & Visual Signaling Devices Market Forecast (2021-2025)

12.2.3 Asia-Pacific Industrial Used Audible & Visual Signaling Devices Market Forecast (2021-2025)

12.2.4 South America Industrial Used Audible & Visual Signaling Devices Market Forecast (2021-2025)

12.2.5 Middle East & Africa Industrial Used Audible & Visual Signaling Devices Market Forecast (2021-2025)

12.3 Industrial Used Audible & Visual Signaling Devices Market Forecast by Type (2021-2025)

12.3.1 Global Industrial Used Audible & Visual Signaling Devices Sales Forecast by Type (2021-2025)

12.3.2 Global Industrial Used Audible & Visual Signaling Devices Market Share Forecast by Type (2021-2025)

12.4 Industrial Used Audible & Visual Signaling Devices Market Forecast by Application (2021-2025)

12.4.1 Global Industrial Used Audible & Visual Signaling Devices Sales Forecast by Application (2021-2025)

12.4.2 Global Industrial Used Audible & Visual Signaling Devices Market Share Forecast by Application (2021-2025)

13 Sales Channel, Distributors, Traders and Dealers

13.1 Sales Channel

13.1.1 Direct Marketing

13.1.2 Indirect Marketing

13.2 Distributors, Traders and Dealers

14 Research Findings and Conclusion

15 Appendix

15.1 Methodology

15.2 Data Source

15.3 Disclaimer

15.4 About US

List of Tables

Table 1. Global Industrial Used Audible & Visual Signaling Devices Revenue (USD Million) by Type: 2015 VS 2019 VS 2025

Table 2. Breakdown of Industrial Used Audible & Visual Signaling Devices by Company Type (Tier 1, Tier 2 and Tier 3)

Table 3. Global Industrial Used Audible & Visual Signaling Devices Revenue (USD Million) by Application: 2015 VS 2019 VS 2025

Table 4. Market Opportunities in Next Few Years

Table 5. Market Risks Analysis

Table 6. Market Drivers

Table 7. Patlite Corporation Basic Information, Manufacturing Base and Competitors

Table 8. Patlite Corporation Industrial Used Audible & Visual Signaling Devices Major Business

Table 9. Patlite Corporation Industrial Used Audible & Visual Signaling Devices Total Revenue (USD Million) (2017-2018)

Table 10. Patlite Corporation SWOT Analysis

Table 11. Patlite Corporation Industrial Used Audible & Visual Signaling Devices Product and Services

Table 12. Patlite Corporation Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

Table 13. Schneider Electric Basic Information, Manufacturing Base and Competitors

Table 14. Schneider Electric Industrial Used Audible & Visual Signaling Devices Major Business

Table 15. Schneider Electric Industrial Used Audible & Visual Signaling Devices Total Revenue (USD Million) (2017-2018)

Table 16. Schneider Electric SWOT Analysis

Table 17. Schneider Electric Industrial Used Audible & Visual Signaling Devices Product and Services

Table 18. Schneider Electric Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

Table 19. Eaton Corporation PLC (Cooper Industries) Basic Information, Manufacturing Base and Competitors

Table 20. Eaton Corporation PLC (Cooper Industries) Industrial Used Audible & Visual Signaling Devices Major Business

Table 21. Eaton Corporation PLC (Cooper Industries) Industrial Used Audible & Visual Signaling Devices Total Revenue (USD Million) (2017-2018)

Table 22. Eaton Corporation PLC (Cooper Industries) SWOT Analysis

Table 23. Eaton Corporation PLC (Cooper Industries) Industrial Used Audible & Visual Signaling Devices Product and Services

Table 24. Eaton Corporation PLC (Cooper Industries) Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

Table 25. Federal Signal Corporation Basic Information, Manufacturing Base and Competitors

Table 26. Federal Signal Corporation Industrial Used Audible & Visual Signaling Devices Major Business

Table 27. Federal Signal Corporation Industrial Used Audible & Visual Signaling Devices Total Revenue (USD Million) (2017-2018)

Table 28. Federal Signal Corporation SWOT Analysis

Table 29. Federal Signal Corporation Industrial Used Audible & Visual Signaling Devices Product and Services

Table 30. Federal Signal Corporation Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

Table 31. Honeywell (Novar GmbH) Basic Information, Manufacturing Base and Competitors

Table 32. Honeywell (Novar GmbH) Industrial Used Audible & Visual Signaling Devices Major Business

Table 33. Honeywell (Novar GmbH) Industrial Used Audible & Visual Signaling Devices Total Revenue (USD Million) (2017-2018)

Table 34. Honeywell (Novar GmbH) SWOT Analysis

Table 35. Honeywell (Novar GmbH) Industrial Used Audible & Visual Signaling Devices Product and Services

Table 36. Honeywell (Novar GmbH) Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

Table 37. Werma Signaltechnik GmbH Basic Information, Manufacturing Base and Competitors

Table 38. Werma Signaltechnik GmbH Industrial Used Audible & Visual Signaling Devices Major Business

Table 39. Werma Signaltechnik GmbH Industrial Used Audible & Visual Signaling Devices Total Revenue (USD Million) (2017-2018)

Table 40. Werma Signaltechnik GmbH SWOT Analysis

Table 41. Werma Signaltechnik GmbH Industrial Used Audible & Visual Signaling Devices Product and Services

Table 42. Werma Signaltechnik GmbH Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

Table 43. Auer Signal Basic Information, Manufacturing Base and Competitors

Table 44. Auer Signal Industrial Used Audible & Visual Signaling Devices Major Business

Table 45. Auer Signal Industrial Used Audible & Visual Signaling Devices Total Revenue (USD Million) (2017-2018)

Table 46. Auer Signal SWOT Analysis

Table 47. Auer Signal Industrial Used Audible & Visual Signaling Devices Product and Services

Table 48. Auer Signal Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

Table 49. Potter Electric Signal Company, LLC Basic Information, Manufacturing Base and Competitors

Table 50. Potter Electric Signal Company, LLC Industrial Used Audible & Visual Signaling Devices Major Business

Table 51. Potter Electric Signal Company, LLC Industrial Used Audible & Visual Signaling Devices Total Revenue (USD Million) (2017-2018)

Table 52. Potter Electric Signal Company, LLC SWOT Analysis

Table 53. Potter Electric Signal Company, LLC Industrial Used Audible & Visual Signaling Devices Product and Services

Table 54. Potter Electric Signal Company, LLC Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

Table 55. Rockwell Automation, Inc. Basic Information, Manufacturing Base and Competitors

Table 56. Rockwell Automation, Inc. Industrial Used Audible & Visual Signaling Devices Major Business

Table 57. Rockwell Automation, Inc. Industrial Used Audible & Visual Signaling Devices Total Revenue (USD Million) (2017-2018)

Table 58. Rockwell Automation, Inc. SWOT Analysis

Table 59. Rockwell Automation, Inc. Industrial Used Audible & Visual Signaling Devices Product and Services

Table 60. Rockwell Automation, Inc. Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

Table 61. R. Stahl AG Basic Information, Manufacturing Base and Competitors

Table 62. R. Stahl AG Industrial Used Audible & Visual Signaling Devices Major Business

Table 63. R. Stahl AG Industrial Used Audible & Visual Signaling Devices Total Revenue (USD Million) (2017-2018)

Table 64. R. Stahl AG SWOT Analysis

Table 65. R. Stahl AG Industrial Used Audible & Visual Signaling Devices Product and Services

Table 66. R. Stahl AG Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

Table 67. Sirena S.p.A. Basic Information, Manufacturing Base and Competitors

Table 68. Sirena S.p.A. Industrial Used Audible & Visual Signaling Devices Major Business

Table 69. Sirena S.p.A. Industrial Used Audible & Visual Signaling Devices Total Revenue (USD Million) (2017-2018)

Table 70. Sirena S.p.A. SWOT Analysis

Table 71. Sirena S.p.A. Industrial Used Audible & Visual Signaling Devices Product and Services

Table 72. Sirena S.p.A. Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

Table 73. E2S Warning Signals Basic Information, Manufacturing Base and Competitors

Table 74. E2S Warning Signals Industrial Used Audible & Visual Signaling Devices Major Business

Table 75. E2S Warning Signals Industrial Used Audible & Visual Signaling Devices Total Revenue (USD Million) (2017-2018)

Table 76. E2S Warning Signals SWOT Analysis

Table 77. E2S Warning Signals Industrial Used Audible & Visual Signaling Devices Product and Services

Table 78. E2S Warning Signals Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

Table 79. Pfannenberg Basic Information, Manufacturing Base and Competitors

Table 80. Pfannenberg Industrial Used Audible & Visual Signaling Devices Major Business

Table 81. Pfannenberg Industrial Used Audible & Visual Signaling Devices Total Revenue (USD Million) (2017-2018)

Table 82. Pfannenberg SWOT Analysis

Table 83. Pfannenberg Industrial Used Audible & Visual Signaling Devices Product and Services

Table 84. Pfannenberg Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

Table 85. Tomar Electronics, Inc Basic Information, Manufacturing Base and Competitors

Table 86. Tomar Electronics, Inc Industrial Used Audible & Visual Signaling Devices Major Business

Table 87. Tomar Electronics, Inc Industrial Used Audible & Visual Signaling Devices Total Revenue (USD Million) (2017-2018)

Table 88. Tomar Electronics, Inc SWOT Analysis

Table 89. Tomar Electronics, Inc Industrial Used Audible & Visual Signaling Devices Product and Services

Table 90. Tomar Electronics, Inc Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

Table 91. Moflash Signalling Ltd Basic Information, Manufacturing Base and Competitors

Table 92. Moflash Signalling Ltd Industrial Used Audible & Visual Signaling Devices Major Business

Table 93. Moflash Signalling Ltd Industrial Used Audible & Visual Signaling Devices Total Revenue (USD Million) (2017-2018)

Table 94. Moflash Signalling Ltd SWOT Analysis

Table 95. Moflash Signalling Ltd Industrial Used Audible & Visual Signaling Devices Product and Services

Table 96. Moflash Signalling Ltd Industrial Used Audible & Visual Signaling Devices Sales, Price, Revenue, Gross Margin and Market Share (2018-2019)

Table 97. Global Industrial Used Audible & Visual Signaling Devices Sales by Manufacturer (2018-2019) (K Units)

Table 98. Global Industrial Used Audible & Visual Signaling Devices Revenue by Manufacturer (2018-2019) (USD Million)

Table 99. Global Industrial Used Audible & Visual Signaling Devices Sales by Regions (2015-2020) (K Units)

Table 100. Global Industrial Used Audible & Visual Signaling Devices Sales Market Share by Regions (2015-2020)

Table 101. Global Industrial Used Audible & Visual Signaling Devices Revenue by Regions (2015-2020) (USD Million)

Table 102. North America Industrial Used Audible & Visual Signaling Devices Sales by Countries (2015-2020) (K Units)

Table 103. North America Industrial Used Audible & Visual Signaling Devices Sales Market Share by Countries (2015-2020)

Table 104. North America Industrial Used Audible & Visual Signaling Devices Revenue by Countries (2015-2020) (USD Million)

Table 105. North America Industrial Used Audible & Visual Signaling Devices Revenue Market Share by Countries (2015-2020)

Table 106. Europe Industrial Used Audible & Visual Signaling Devices Sales by Countries (2015-2020) (K Units)

Table 107. Europe Industrial Used Audible & Visual Signaling Devices Sales Market Share by Countries (2015-2020)

Table 108. Europe Industrial Used Audible & Visual Signaling Devices Revenue by Countries (2015-2020) (USD Million)

Table 109. Asia-Pacific Industrial Used Audible & Visual Signaling Devices Sales by Regions (2015-2020) (K Units)

Table 110. Asia-Pacific Industrial Used Audible & Visual Signaling Devices Sales Market Share by Regions (2015-2020)

Table 111. Asia-Pacific Industrial Used Audible & Visual Signaling Devices Revenue by Regions (2015-2020) (USD Million)

Table 112. South America Industrial Used Audible & Visual Signaling Devices Sales by Countries (2015-2020) (K Units)

Table 113. South America Industrial Used Audible & Visual Signaling Devices Sales Market Share by Countries (2015-2020)

Table 114. South America Industrial Used Audible & Visual Signaling Devices Revenue by Countries (2015-2020) (USD Million)

Table 115. South America Industrial Used Audible & Visual Signaling Devices Revenue Market Share by Countries (2015-2020)

Table 116. Middle East & Africa Industrial Used Audible & Visual Signaling Devices Sales by Countries (2015-2020) (K Units)

Table 117. Middle East & Africa Industrial Used Audible & Visual Signaling Devices Sales Market Share by Countries (2015-2020)

Table 118. Middle East & Africa Industrial Used Audible & Visual Signaling Devices Revenue by Countries (2015-2020) (USD Million)

Table 119. Middle East & Africa Industrial Used Audible & Visual Signaling Devices Revenue Market Share by Countries (2015-2020)

Table 120. Global Industrial Used Audible & Visual Signaling Devices Sales by Type (2015-2020) (K Units)

Table 121. Global Industrial Used Audible & Visual Signaling Devices Sales Share by Type (2015-2020)

Table 122. Global Industrial Used Audible & Visual Signaling Devices Revenue by Type (2015-2020) (USD Million)

Table 123. Global Industrial Used Audible & Visual Signaling Devices Revenue Share by Type (2015-2020)

Table 124. Global Industrial Used Audible & Visual Signaling Devices Sales by Application (2015-2020) (K Units)

Table 125. Global Industrial Used Audible & Visual Signaling Devices Sales Share by Application (2015-2020)

Table 126. Global Industrial Used Audible & Visual Signaling Devices Sales Forecast by Regions (2021-2025) (K Units)

Table 127. Global Industrial Used Audible & Visual Signaling Devices Market Share Forecast by Regions (2021-2025)

Table 128. Global Industrial Used Audible & Visual Signaling Devices Sales Forecast by Type (2021-2025) (K Units)

Table 129. Global Industrial Used Audible & Visual Signaling Devices Market Share Forecast by Type (2021-2025)

Table 130. Global Industrial Used Audible & Visual Signaling Devices Sales Forecast by Application (2021-2025)

Table 131. Global Industrial Used Audible & Visual Signaling Devices Market Share Forecast by Application (2021-2025)

Table 132. Direct Channel Pros & Cons

Table 133. Indirect Channel Pros & Cons

Table 134. Distributors/Traders/ Dealers List

List of Figures

Figure 1. Industrial Used Audible & Visual Signaling Devices Picture

Figure 2. Global Sales Market Share of Industrial Used Audible & Visual Signaling Devices by Type in 2019

Figure 3. Strobe and Beacons Picture

Figure 4. Signal Towers Picture

Figure 5. Bells and Horns Picture

Figure 6. Fire Alarm/Call Points Picture

Figure 7. Speakers and Tone Generators Picture

Figure 8. Visual & Audible Combination Units Picture

Figure 9. Industrial Used Audible & Visual Signaling Devices Sales Market Share by Application in 2018

Figure 10. Oil and Gas Picture

Figure 11. Chemical and Pharmaceutical Picture

Figure 12. Food and Beverages Picture

Figure 13. Energy and Power Picture

Figure 14. Mining Picture

Figure 15. Others Picture

Figure 16. Global Industrial Used Audible & Visual Signaling Devices Market Status and Outlook (2015-2025) (USD Million)

Figure 17. United States Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 18. Canada Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 19. Mexico Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 20. Germany Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 21. France Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 22. UK Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 23. Russia Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 24. Italy Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 25. China Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 26. Japan Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 27. Korea Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 28. India Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 29. Southeast Asia Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 30. Australia Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025) (USD Million)

Figure 31. Brazil Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 32. Egypt Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 33. Saudi Arabia Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 34. South Africa Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 35. Turkey Industrial Used Audible & Visual Signaling Devices Revenue (Value) and Growth Rate (2015-2025)

Figure 36. Global Industrial Used Audible & Visual Signaling Devices Sales Market Share by Manufacturer in 2019

Figure 37. Global Industrial Used Audible & Visual Signaling Devices Revenue Market Share by Manufacturer in 2019

Figure 38. Top 3 Industrial Used Audible & Visual Signaling Devices Manufacturer (Revenue) Market Share in 2019

Figure 39. Top 6 Industrial Used Audible & Visual Signaling Devices Manufacturer (Revenue) Market Share in 2019

Figure 40. Key Manufacturer Market Share Trend

Figure 41. Global Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 42. Global Industrial Used Audible & Visual Signaling Devices Revenue and Growth Rate (2015-2020) (USD Million)

Figure 43. Global Industrial Used Audible & Visual Signaling Devices Revenue Market Share by Regions (2015-2020)

Figure 44. Global Industrial Used Audible & Visual Signaling Devices Revenue Market Share by Regions in 2018

Figure 45. North America Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

Figure 46. Europe Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

Figure 47. Asia-Pacific Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

Figure 48. South America Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

Figure 49. Middle East & Africa Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020)

Figure 50. North America Industrial Used Audible & Visual Signaling Devices Revenue and Growth Rate (2015-2020) (USD Million)

Figure 51. North America Industrial Used Audible & Visual Signaling Devices Sales Market Share by Countries (2015-2020)

Figure 52. North America Industrial Used Audible & Visual Signaling Devices Sales Market Share by Countries in 2018

Figure 53. North America Industrial Used Audible & Visual Signaling Devices Revenue Market Share by Countries (2015-2020) (USD Million)

Figure 54. North America Industrial Used Audible & Visual Signaling Devices Revenue Market Share by Countries in 2018

Figure 55. United States Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 56. Canada Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 57. Mexico Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 58. Europe Industrial Used Audible & Visual Signaling Devices Revenue and Growth Rate (2015-2020) (USD Million)

Figure 59. Europe Industrial Used Audible & Visual Signaling Devices Revenue Market Share by Countries (2015-2020)

Figure 60. Europe Industrial Used Audible & Visual Signaling Devices Revenue Market Share by Countries in 2019

Figure 61. Germany Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 62. UK Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 63. France Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 64. Russia Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 65. Italy Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 66. Asia-Pacific Industrial Used Audible & Visual Signaling Devices Revenue and Growth Rate (2015-2020) (USD Million)

Figure 67. Asia-Pacific Industrial Used Audible & Visual Signaling Devices Sales Market Share by Regions 2019

Figure 68. Asia-Pacific Industrial Used Audible & Visual Signaling Devices Revenue Market Share by Regions 2019

Figure 69. China Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 70. Japan Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 71. Korea Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 72. India Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 73. Southeast Asia Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 74. South America Industrial Used Audible & Visual Signaling Devices Revenue and Growth Rate (2015-2020) (USD Million)

Figure 75. South America Industrial Used Audible & Visual Signaling Devices Sales Market Share by Countries in 2019

Figure 76. South America Industrial Used Audible & Visual Signaling Devices Revenue Market Share by Countries in 2019

Figure 77. Brazil Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 78. Argentina Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 79. Middle East and Africa Industrial Used Audible & Visual Signaling Devices Revenue and Growth Rate (2015-2020) (USD Million)

Figure 80. Middle East and Africa Industrial Used Audible & Visual Signaling Devices Sales Market Share by Countries in 2019

Figure 81. Middle East and Africa Industrial Used Audible & Visual Signaling Devices Revenue Market Share by Countries (2015-2020)

Figure 82. Middle East and Africa Industrial Used Audible & Visual Signaling Devices Revenue Market Share by Countries in 2019

Figure 83. Saudi Arabia Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 84. Egypt Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 85. Turkey Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 86. South Africa Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2015-2020) (K Units)

Figure 87. Global Industrial Used Audible & Visual Signaling Devices Sales and Growth Rate (2021-2025) (K Units)

Figure 88. Global Industrial Used Audible & Visual Signaling Devices Revenue and Growth Rate (2021-2025) (USD Million)

Figure 89. North America Sales Industrial Used Audible & Visual Signaling Devices Market Forecast (2021-2025) (K Units)

Figure 90. Europe Sales Industrial Used Audible & Visual Signaling Devices Market Forecast (2021-2025) (K Units)

Figure 91. Asia-Pacific Sales Industrial Used Audible & Visual Signaling Devices Market Forecast (2021-2025) (K Units)

Figure 92. South America Sales Industrial Used Audible & Visual Signaling Devices Market Forecast (2021-2025) (K Units)

Figure 93. Middle East & Africa Sales Industrial Used Audible & Visual Signaling Devices Market Forecast (2021-2025) (K Units)

Figure 94. Sales Channel: Direct Channel vs Indirect Channel

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

Our market research process involves with the four specific stages.

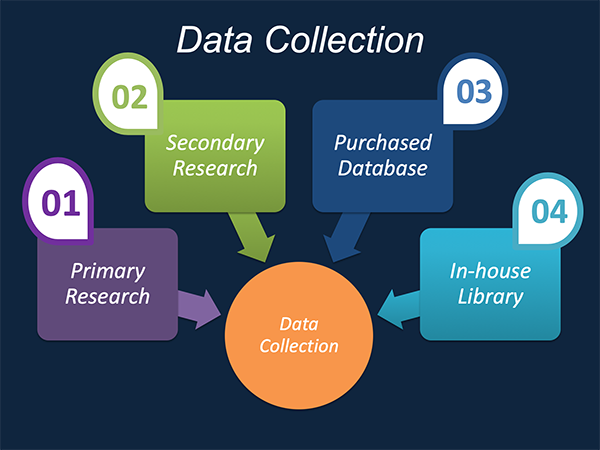

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

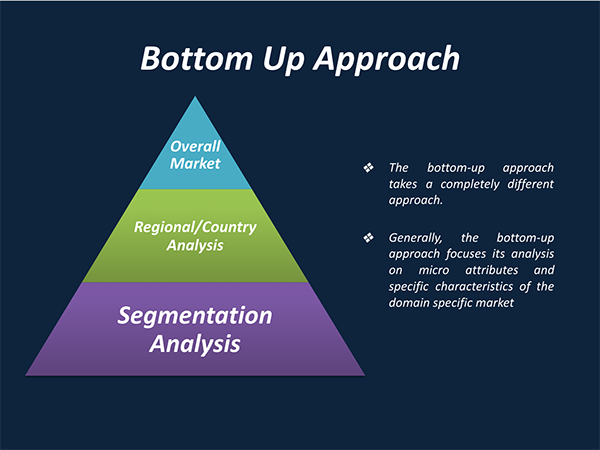

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

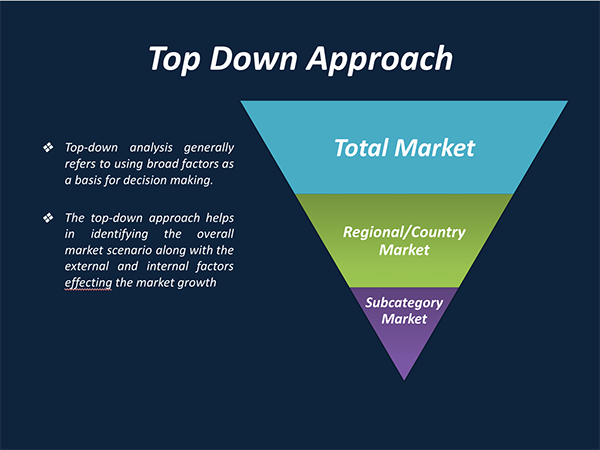

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.