The global integrated passive devices market is expected to grow from USD 1.9 billion in 2020 to USD 3.87 billion by 2028, at a CAGR of 9.3% during the forecast period 2021-2028.

Integrated passive devices (IPDs), also known as integrated passive components (IPCs), or embedded passive components are electronic components that combine resistors (R), capacitors (C), inductors (L)/coils/chokes, microstriplines, impedance matching elements, baluns, or any combination of these components in a single package or on the same substrate. Integrated passives are often referred to as embedded passives, and the distinction between integrated and embedded passives is still debated. Passives are realised in between dielectric layers or on the same substrate in situations. Resistor, capacitor, resistor-capacitor (RC), and resistor-capacitor-coil/inductor (RCL) networks are the first types of IPDs. By stacking two coils on top of each other and separating them with a thin dielectric layer, passive transformers may be realised as integrated passive devices. When the substrate is silicon or another semiconductor like gallium arsenide, diodes (PN, PIN, zener, etc.) can sometimes be integrated on the same substrate with integrated passives (GaAs).

Factors such as increased usage of IPD in consumer durables, integration of IPDs into RF applications, and rising need for miniaturised & high-performance electronic devices are driving the growth of the integrated passive devices market. In addition, the growing use of entertainment and navigation technologies in vehicles, such as the global positioning system (GPS), is driving market development. The COVID-19 pandemic has had a significant influence on the semiconductor industry, limiting the market for integrated passive devices. Global semiconductor sales fell by 3.6 percent in the first quarter of 2020, according to the Semiconductor Industry Association, due to supply-chain disruptions caused by the COVID-19 pandemic. Several major consumer electronics and automobile OEMs have also suspended production as a result of the government's various lockdown scenarios. For a brief time, this has slowed the adoption of integrated passive devices. In AI and 5G terminal devices, integrated passive devices provide excellent performance, a small footprint, and energy efficiency, increasing their market demand. According to the GSM Association, by 2025, the total number of global 5G connections would exceed 1.8 billion. IPD makers will have even more opportunities to create smaller and power-efficient 5G equipment as a result of this.

This study delivers a comprehensive analysis of material, industry verticals, and region. The material segment includes glass and silicon. The silicon segment held the largest market share of integrated passive devices market in the year 2020. Silicon-based integrated passive devices may be ground to a thickness of 100 micrometres using a variety of packaging techniques such as wire bonding, nano bumping, and copper pads. The industry verticals segment includes consumer electronics, automotive, aerospace &defence, telecommunication, medical & healthcare, and others. The consumer electronics segment held the largest market share of the integrated passive devices market in the year 2020. Increased usage of electronic components in different consumer electronics products such as smartphones, laptops, tablets, and wearable, among others, is credited with the market development.

The market has been divided into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. In 2020, Asia Pacific accounted for the most of the global integrated passive devices market. Due to growing disposable incomes and improved standards of life in countries such as India, Asia-Pacific dominates the integrated passive device market. From 2021 to 2028, the Asia Pacific integrated passive devices market will increase, owing to government measures to expand semiconductor production in the area. Because of growing investments in the technical industry, Europe is also anticipated to develop the most in the integrated passive device market over the forecast period. Rising government backing and attempts to speed up semiconductor production in the Europe region are driving the growth of the market. To encourage international and domestic companies to the semiconductor sector, The European Union launched the “European Union's Horizon 2020” research and innovation initiative, which has a budget of about USD 94 billion.

STMicroelectronics, Murata Manufacturing Co. Ltd., ON Semiconductors, Texas Instruments, 3DiS Technologies, Johnson Technology, STATS ChipPAC Ltd., Micron Technology, Inc., Global Communication Semiconductors, Inc. and Infineon Technologies AG are some of the key participants in the integrated passive devices market.

Global Integrated Passive Devices Market, Analysis and Forecast, By Material

Global Integrated Passive Devices Market, Analysis and Forecast, By Industry Verticals

Global Integrated Passive Devices Market, Analysis and Forecast, Region

Report Description:

1. Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Research Scope

1.4. Currency

1.5. Key Target Audience

2. Research Methodology and Assumptions

3. Executive Summary

4. Premium Insights

4.1. Porter’s Five Forces Analysis

4.2. Value Chain Analysis

4.3. Top Investment Pockets

4.3.1. Market Attractiveness Analysis By Material

4.3.2. Market Attractiveness Analysis By Industry Verticals

4.3.3. Market Attractiveness Analysis By Region

4.4. Industry Trends

5. Market Dynamics

5.1. Market Evaluation

5.2. Drivers

5.2.1. Increased usage of IPD in consumer durables

5.2.2. Integration of IPDs into RF applications

5.2.3. Rising need for miniaturised & high-performance electronic devices

5.2.4. The growing use of entertainment and navigation technologies in vehicles

5.3. Restrains

5.3.1. The COVID-19 pandemic

5.3.2. Slow adoption of integrated passive devices due to government regulations

5.4. Opportunities

5.4.1. Growing demand and need for 5G connections across various sectors

6. Global Integrated Passive Devices Market Analysis and Forecast, By Material

6.1. Segment Overview

6.2. Glass

6.3. Silicon

7. Global Integrated Passive Devices Market Analysis and Forecast, By Industry Verticals

7.1. Segment Overview

7.2. Consumer Electronics

7.3. Automotive

7.4. Aerospace & Defense

7.5. Telecommunication

7.6. Medical & Healthcare

7.7. Others

8. Global Integrated Passive Devices Market Analysis and Forecast, By Regional Analysis

8.1. Segment Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.2.3. Mexico

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.4. Asia-Pacific

8.4.1. Japan

8.4.2. China

8.4.3. India

8.5. South America

8.5.1. Brazil

8.6. Middle East and Africa

8.6.1. UAE

8.6.2. South Africa

9. Global Integrated Passive Devices Market-Competitive Landscape

9.1. Overview

9.2. Market Share of Key Players in Global Integrated Passive Devices Market

9.2.1. Global Company Market Share

9.2.2. North America Company Market Share

9.2.3. Europe Company Market Share

9.2.4. APAC Company Market Share

9.3. Competitive Situations and Trends

9.3.1. Product Launches and Developments

9.3.2. Partnerships, Collaborations, and Agreements

9.3.3. Mergers & Acquisitions

9.3.4. Expansions

10. Company Profiles

10.1. STMicroelectronics

10.1.1. Business Overview

10.1.2. Company Snapshot

10.1.3. Company Market Share Analysis

10.1.4. Company Product Portfolio

10.1.5. Recent Developments

10.1.6. SWOT Analysis

10.2. Murata Manufacturing Co. Ltd.

10.2.1. Business Overview

10.2.2. Company Snapshot

10.2.3. Company Market Share Analysis

10.2.4. Company Product Portfolio

10.2.5. Recent Developments

10.2.6. SWOT Analysis

10.3. ON Semiconductors

10.3.1. Business Overview

10.3.2. Company Snapshot

10.3.3. Company Market Share Analysis

10.3.4. Company Product Portfolio

10.3.5. Recent Developments

10.3.6. SWOT Analysis

10.4. Texas Instruments

10.4.1. Business Overview

10.4.2. Company Snapshot

10.4.3. Company Market Share Analysis

10.4.4. Company Product Portfolio

10.4.5. Recent Developments

10.4.6. SWOT Analysis

10.5. 3DiS Technologies

10.5.1. Business Overview

10.5.2. Company Snapshot

10.5.3. Company Market Share Analysis

10.5.4. Company Product Portfolio

10.5.5. Recent Developments

10.5.6. SWOT Analysis

10.6. Johnson Technology

10.6.1. Business Overview

10.6.2. Company Snapshot

10.6.3. Company Market Share Analysis

10.6.4. Company Product Portfolio

10.6.5. Recent Developments

10.6.6. SWOT Analysis

10.7. STATS ChipPAC Ltd.

10.7.1. Business Overview

10.7.2. Company Snapshot

10.7.3. Company Market Share Analysis

10.7.4. Company Product Portfolio

10.7.5. Recent Developments

10.7.6. SWOT Analysis

10.8. Micron Technology, Inc.

10.8.1. Business Overview

10.8.2. Company Snapshot

10.8.3. Company Market Share Analysis

10.8.4. Company Product Portfolio

10.8.5. Recent Developments

10.8.6. SWOT Analysis

10.9. Global Communication Semiconductors, Inc.

10.9.1. Business Overview

10.9.2. Company Snapshot

10.9.3. Company Market Share Analysis

10.9.4. Company Product Portfolio

10.9.5. Recent Developments

10.9.6. SWOT Analysis

10.10. Infineon Technologies AG

10.10.1. Business Overview

10.10.2. Company Snapshot

10.10.3. Company Market Share Analysis

10.10.4. Company Product Portfolio

10.10.5. Recent Developments

10.10.6. SWOT Analysis

List of Table

1. Global Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

2. Global Glass, Integrated Passive Devices Market, By Region, 2018-2028 (USD Billion) (K Units)

3. Global Silicon, Integrated Passive Devices Market, By Region, 2018-2028 (USD Billion) (K Units)

4. Global Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

5. Global Consumer Electronics, Integrated Passive Devices Market, By Region, 2018-2028 (USD Billion) (K Units)

6. Global Automotive, Integrated Passive Devices Market, By Region, 2018-2028 (USD Billion) (K Units)

7. Global Aerospace & Defense, Integrated Passive Devices Market, By Region, 2018-2028 (USD Billion) (K Units)

8. Global Telecommunication, Integrated Passive Devices Market, By Region, 2018-2028 (USD Billion) (K Units)

9. Global Medical &Healthcare, Integrated Passive Devices Market, By Region, 2018-2028 (USD Billion) (K Units)

10. Global Others, Integrated Passive Devices Market, By Region, 2018-2028 (USD Billion) (K Units)

11. North America Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

12. North America Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

13. U.S. Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

14. U.S. Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

15. Canada Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

16. Canada Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

17. Mexico Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

18. Mexico Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

19. Europe Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

20. Europe Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

21. Germany Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

22. Germany Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

23. France Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

24. France Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

25. U.K. Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

26. U.K. Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

27. Italy Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

28. Italy Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

29. Spain Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

30. Spain Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

31. Asia Pacific Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

32. Asia Pacific Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

33. Japan Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

34. Japan Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

35. China Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

36. China Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

37. India Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

38. India Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

39. South America Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

40. South America Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

41. Brazil Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

42. Brazil Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

43. Middle East and Africa Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

44. Middle East and Africa Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

45. UAE Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

46. UAE Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

47. South Africa Integrated Passive Devices Market, By Material, 2018-2028 (USD Billion) (K Units)

48. South Africa Integrated Passive Devices Market, By Industry Verticals, 2018-2028 (USD Billion) (K Units)

List of Figures

1. Global Integrated Passive Devices Market Segmentation

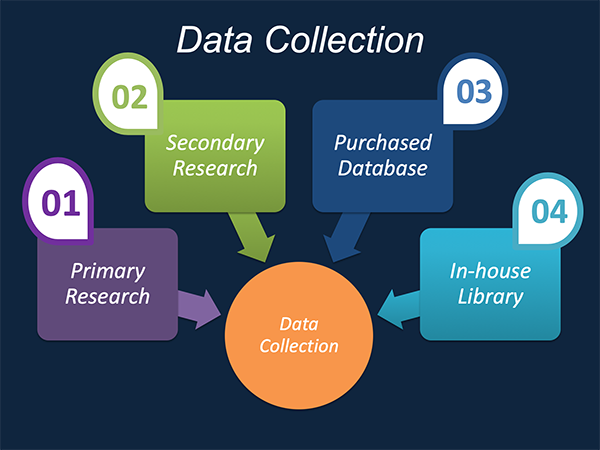

2. Global Integrated Passive Devices Market: Research Methodology

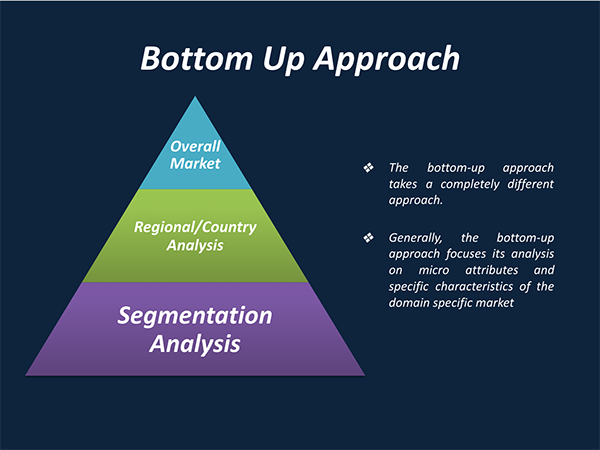

3. Market Size Estimation Methodology: Bottom-Up Approach

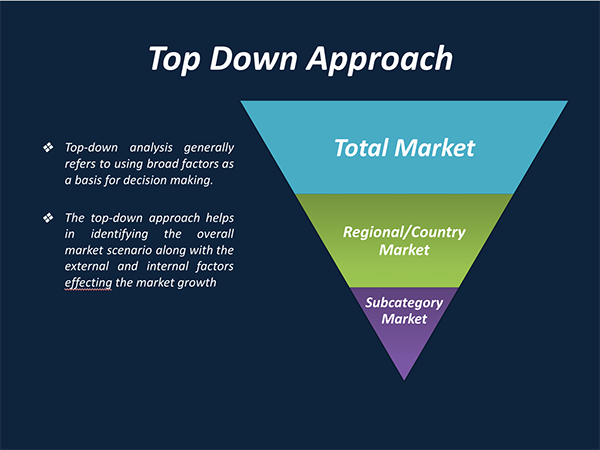

4. Market Size Estimation Methodology: Top-Down Approach

5. Data Triangulation

6. Porter’s Five Forces Analysis

7. Value Chain Analysis

8. Global Integrated Passive Devices Market Attractiveness Analysis By Material

9. Global Integrated Passive Devices Market Attractiveness Analysis By Industry Verticals

10. Global Integrated Passive Devices Market Attractiveness Analysis By Region

11. Global Integrated Passive Devices Market: Dynamics

12. Global Integrated Passive Devices Market Share By Material (2021 & 2028)

13. Global Integrated Passive Devices Market Share By Industry Verticals (2021 & 2028)

14. Global Integrated Passive Devices Market Share by Regions (2021 & 2028)

15. Global Integrated Passive Devices Market Share by Company (2020)

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

Our market research process involves with the four specific stages.

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.