The global odor control system market is expected to grow from USD 1.97 billion in 2019 to USD 2.93 billion by 2027, at a CAGR of 5.07% during the forecast period from 2020-2027.

Odor release from wastewater treatment facilities, oil and gas refineries, and various manufacturing facilities have an unpleasant smell and impact on an environment, plant workers' productivity, and community's wellbeing. Many industrial and manufacturing facilities are now facing the challenges to control the odor and to maintain the ambient air standards. Odor control system helps to remove the odor arises from a variety of compounds such as mercaptans, hydrogen sulfide, amines, ammonia, volatile organic compounds, and general nuisance odor.

Increasing demand to reduce the foul smell in the manufacturing facilities and at the wastewater treatment plants is the key factor driving the growth of the market. Manufacturing facilities such as food & beverage processing, pharmaceutical, and industrial and municipal settings, foul odor are a common challenge. It affects the workers' safety and productivity. In addition to this, residents, commuters, business owners who stay near these facilities, also faces the odor challenge. Thus, to reduce the bad odor, the demand for odor control systems has been increasing from the past few years. In addition to this, rise in stringent regulations for bad smell, which is harmful to an environment, boosting the growth of the market. However, these systems are quite expensive, which could hamper the growth of the market.

This study delivers a comprehensive analysis of type, application, and region. The type segment includes chemical odor control systems, activated carbon odor control systems, and biological odor control systems. The activated carbon odor control systems segment dominated the market and held the major market share of 37.25% in the year 2019. Activated carbon acts as adsorbent and removes unwanted odor by trapping it into the particles, through its micro and macro pores. Activated coal carbon and coconut are some of the excellent solution for the odor control, due to its large surface areas. It is one of the widely used odor control systems due to its cost-effectiveness and higher efficiency. Application segment classified into chemical industry, oil refineries & petrochemical industry, waste treatment facilities, food & beverages, pulp & paper industry, manufacturing, and others. The manufacturing segment is estimated to grow at the highest CAGR of 5.57% over the forecast period. Manufacturing facilities such as chemical, pharmaceutical, herbicide & pesticide, emits a very unpleasant smell, which hampers the productivity and quality of life. Thus, many manufacturers are now actively installing the odor control systems in their facilities to remove the bad odor. With the increasing adoption of odor control systems in manufacturing, the market is likely to drive in the upcoming years.

The odor control system market has been divided into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. The Asia Pacific region dominated the market and held a share of 32.26% in the year 2019. Increasing industrialization in countries such as China and India is the key factor driving the demand for effective odor control system in this region. Furthermore, increasing various government initiatives for effective odor management, further propelling the growth of the market in the Asia Pacific region.

Some of the prominent players in the odor control system market are Evoqua Water Technologies LLC, Siemens, KCH Services Inc., Romtec Utilities, Inc., Integrity Municipal Systems, LLC, Tholander Ablufttechnik GMBH, Environmental Integrated Solutions, IPEC NV, Bulbeck Group, and ECS Environmental Systems among others. Major players are continuously focusing on strategic partnerships, new developments, acquisitions, and venture capital investments to obtain high growth to gain a significant share in the market. In January 2018, Evoqua Water Technologies LLC announced that it secured the contract for an odor control project from wastewater treatment plant (WWTP) in Western Canada.

This study forecasts revenue growth at global, regional, and country levels from 2013 to 2027. Fior Markets has segmented the on the basis of below-mentioned segments:

Chapter 1 Introduction 25

1.1 Research Methodology 25

1.2 FMR Desk Research 26

1.2.1 FMR Data Synthesis 27

1.2.2 Data Validation And Market Feedback 27

1.2.3 FMR Data Sources 28

Chapter 2 Report Overview 30

2.1 Definition and Specification 30

2.2 Report Overview 32

2.2.1 Manufacturers Overview 32

2.2.2 Regions Overview 34

2.2.3 Type Overview 35

2.2.4 Application Overview 37

2.3 Industrial Chain 42

2.3.1 Odor Control System Overall Industrial Chain 42

2.3.2 Upstream Analysis 42

2.3.3 Downstream Analysis 43

2.4 Industry Situation 43

2.4.1 Industrial Policy 43

Chapter 3 Product Type Market 45

3.1 Product Type Market Performance (Volume) 45

3.1.1 Overall Market Performance (Volume) 45

3.1.2 Chemical Odor Control Systems Market Performance (Volume) 48

3.1.3 Activated Carbon Odor Control Systems Market Performance (Volume) 49

3.1.4 Biological Odor Control Systems Market Performance (Volume) 50

3.2 Product Type Market Performance (Value) 51

3.2.1 Overall Market Performance (Value) 51

3.2.2 Chemical Odor Control Systems Market Performance (Value) 54

3.2.3 Activated Carbon Odor Control Systems Market Performance (Value) 55

3.2.4 Biological Odor Control Systems Market Performance (Value) 56

Chapter 4 Product Application Market 57

4.1 Product Application Market Performance (Volume) 57

4.1.1 Overall Market Performance (Volume) 57

4.1.2 Chemical Industry Market Performance (Volume) 60

4.1.3 Oil Refineries & Petrochemical Industry Market Performance (Volume) 61

4.1.4 Waste Treatment Facilities Market Performance (Volume) 62

4.1.5 Food & Beverages Market Performance (Volume) 63

4.1.6 Pulp & Paper Industry Market Performance (Volume) 64

4.1.7 Manufacturing Market Performance (Volume) 65

4.1.8 Others Market Performance (Volume) 66

Chapter 5 Manufacturers Profiles/Analysis 67

5.1 Evoqua Water Technologies LLC 67

5.1.1 Business Overview 67

5.1.2 Odor Control System of Evoqua Water Technologies LLC 68

5.1.3 Evoqua Water Technologies LLC Odor Control System Sales, Price, Revenue, Gross Margin and Market Share (2013-2018) 70

5.1.4 SWOT Analysis 71

5.2 Siemens 72

5.2.1 Business Overview 72

5.2.2 Recent Development 73

5.2.3 SWOT Analysis 74

5.3 KCH Services Inc. 75

5.3.1 Business Overview 75

5.3.2 Odor Control System of KCH Services Inc. 76

5.3.3 KCH Services Inc. Odor Control System Sales, Price, Revenue, Gross Margin and Market Share (2013-2018) 77

5.3.4 SWOT Analysis 78

5.4 Romtec Utilities, Inc. 79

5.4.1 Business Overview 79

5.4.2 Odor Control System of Romtec Utilities, Inc. 80

5.4.3 Romtec Utilities, Inc. Odor Control System Sales, Price, Revenue, Gross Margin and Market Share (2013-2018) 81

5.4.4 SWOT Analysis 82

5.5 Integrity Municipal Systems, LLC 83

5.5.1 Business Overview 83

5.5.2 Odor Control System of Integrity Municipal Systems, LLC 84

5.5.3 Integrity Municipal Systems, LLC Odor Control System Sales, Price, Revenue, Gross Margin and Market Share (2013-2018) 86

5.5.4 SWOT Analysis 87

5.6 Tholander Ablufttechnik GMBH 88

5.6.1 Business Overview 88

5.6.2 Odor Control System of Tholander Ablufttechnik GMBH 89

5.6.3 Tholander Ablufttechnik GMBH Odor Control System Sales, Price, Revenue, Gross Margin and Market Share (2013-2018) 90

5.6.4 SWOT Analysis 91

5.7 Environmental Integrated Solutions 92

5.7.1 Business Overview 92

5.7.2 Odor Control System of Environmental Integrated Solutions 94

5.7.3 Environmental Integrated Solutions Odor Control System Sales, Price, Revenue, Gross Margin and Market Share (2013-2018) 96

5.7.4 SWOT Analysis 97

5.8 IPEC NV 98

5.8.1 Business Overview 98

5.8.2 Odor Control System of IPEC NV 99

5.8.3 IPEC NV Odor Control System Sales, Price, Revenue, Gross Margin and Market Share (2013-2018) 102

5.8.4 SWOT Analysis 103

5.9 Bulbeck Group 104

5.9.1 Business Overview 104

5.9.2 Odor Control System of Bulbeck Group 105

5.9.3 Bulbeck Group Odor Control System Sales, Price, Revenue, Gross Margin and Market Share (2013-2018) 107

5.9.4 SWOT Analysis 108

5.10 ECS Environmental Systems 109

5.10.1 Business Overview 109

5.10.2 Odor Control System of ECS Environmental Systems 111

5.10.3 SWOT Analysis 114

5.11 Bioair Solutions, LLC 115

5.11.1 Business Overview 115

5.11.2 Odor Control System of Bioair Solutions, LLC 116

5.11.3 Bioair Solutions, LLC Odor Control System Sales, Price, Revenue, Gross Margin and Market Share (2013-2018) 120

5.11.4 SWOT Analysis 121

5.12 Purafil, Inc. 122

5.12.1 Business Overview 122

5.12.2 Odor Control System of Purafil, Inc. 124

5.12.3 Purafil, Inc. Odor Control System Sales, Price, Revenue, Gross Margin and Market Share (2013-2018) 126

5.12.4 SWOT Analysis 127

5.13 ERG Air Pollution Control Ltd 128

5.13.1 Business Overview 128

5.13.2 Odor Control System of ERG Air Pollution Control Ltd 129

5.13.3 ERG Air Pollution Control Ltd Odor Control System Sales, Price, Revenue, Gross Margin and Market Share (2013-2018) 133

5.13.4 SWOT Analysis 134

5.14 Aarcon Odour Control 135

5.14.1 Business Overview 135

5.14.2 Odor Control System of Aarcon Odour Control 136

5.14.3 Aarcon Odour Control Odor Control System Sales, Price, Revenue, Gross Margin and Market Share (2013-2018) 137

5.14.4 SWOT Analysis 138

5.15 Ecolab 139

5.15.1 Business Overview 139

5.15.2 Odor Control System of Ecolab 140

5.15.3 Ecolab Odor Control System Sales, Price, Revenue, Gross Margin and Market Share (2013-2018) 141

5.15.4 SWOT Analysis 142

5.16 Cloud Tech Pvt. Ltd. 143

5.16.1 Business Overview 143

5.16.2 Odor Control System of cloud Tech Pvt. Ltd. 144

5.16.3 SWOT Analysis 145

5.17 Paramount Limited 146

5.17.1 Business Overview 146

5.17.2 Odor Control System of Paramount Limited 148

5.17.3 SWOT Analysis 149

Chapter 6 Global Market Performance for Manufacturers 150

6.1 Global Odor Control System Sales (Unit) and Share of Manufacturers 2013-2018 150

6.2 Global Odor Control System Revenue (Million USD) and Share of Manufacturers 2013-2018 155

6.3 Global Odor Control System Price (USD/Unit) of Manufacturers 2013-2018 160

6.4 Global Odor Control System Gross Margin of Manufacturers 2013-2018 163

6.5 Market Concentration 167

Chapter 7 Regional Market Analysis for Manufacturers 170

7.1 North America Odor Control System Market Performance for Manufacturers 170

7.1.1 North America Odor Control System Sales (Unit) and Share of Manufacturers 2013-2018 170

7.1.2 North America Odor Control System Revenue (Million USD) and Share of Manufacturers 2013-2018 175

7.1.3 North America Odor Control System Price (USD/Unit) of Manufacturers 2013-2018 180

7.1.4 North America Odor Control System Gross Margin of Manufacturers 2013-2018 183

7.1.5 Market Concentration 186

7.3 Europe Odor Control System Market Performance for Manufacturers 204

7.3.1 Europe Odor Control System Sales (Unit) and Share of Manufacturers 2013-2018 204

7.3.2 Europe Odor Control System Revenue (Million USD) and Share of Manufacturers 2013-2018 209

7.3.3 Europe Odor Control System Price (USD/Unit) of Manufacturers 2013-2018 214

7.3.4 Europe Odor Control System Gross Margin of Manufacturers 2013-2018 217

7.3.5 Market Concentration 220

7.4 Asia Pacific Odor Control System Market Performance for Manufacturers 221

7.4.1 Asia Pacific Odor Control System Sales (Unit) and Share of Manufacturers 2013-2018 221

7.4.2 Asia Pacific Odor Control System Revenue (Million USD) and Share of Manufacturers 2013-2018 225

7.4.3 Asia Pacific Odor Control System Price (USD/Unit) of Manufacturers 2013-2018 229

7.4.4 Asia Pacific Odor Control System Gross Margin of Manufacturers 2013-2018 232

7.4.5 Market Concentration 235

7.7 Middle East & Africa Odor Control System Market Performance for Manufacturers 266

7.7.1 Middle East & Africa Odor Control System Sales (Unit) and Share of Manufacturers 2013-2018 266

7.7.2 Middle East & Africa Odor Control System Revenue (Million USD) and Share of Manufacturers 2013-2018 271

7.7.3 Middle East & Africa Odor Control System Price (USD/Unit) of Manufacturers 2013-2018 276

7.7.4 Middle East & Africa Odor Control System Gross Margin of Manufacturers 2013-2018 279

7.7.5 Market Concentration 282

7.8 South America Odor Control System Market Performance for Manufacturers 283

7.8.1 South America Odor Control System Sales (Unit) and Share of Manufacturers 2013-2018 283

7.8.2 South America Odor Control System Revenue (Million USD) and Share of Manufacturers 2013-2018 288

7.8.3 South America Odor Control System Price (USD/Unit) of Manufacturers 2013-2018 293

7.8.4 South America Odor Control System Gross Margin of Manufacturers 2013-2018 296

7.8.5 Market Concentration 299

Chapter 8 Global Odor Control System Market Performance (Sales) 300

8.1 Global Odor Control System Sales (Unit) and Share by Regions 2013-2018 300

8.2 Global Odor Control System Revenue (Million USD) and Share by Regions 2013-2018 304

8.3 Global Odor Control System Price (USD/Unit) by Regions 2013-2018 308

Chapter 9 Development Trend for Regions (Odor Control System Sales Point) 311

9.1 Global Odor Control System Sales (Unit), Revenue (Million USD) and Growth Rate 2013-2018 311

9.2 North America Odor Control System Sales (Unit), Revenue (Million USD) and Growth Rate 2013-2018 313

9.4 Europe Odor Control System Sales (Unit), Revenue (Million USD) and Growth Rate 2013-2018 317

9.5 Asia Pacific Odor Control System Sales (Unit), Revenue (Million USD) and Growth Rate 2013-2018 319

9.8 Middle East & Africa Odor Control System Sales (Unit), Revenue (Million USD) and Growth Rate 2013-2018 325

9.9 South America Odor Control System Sales (Unit), Revenue (Million USD) and Growth Rate 2013-2018 327

Chapter 10 Channel Analysis 331

10.1 Market Channel 331

10.1.1 Direct Marketing 332

10.1.2 Indirect Marketing 334

10.2 Distributors 335

Chapter 11 Consumer Analysis 336

11.1 Chemical Industry 336

11.2 Oil Refineries & Petrochemical Industry 336

11.3 Waste Treatment Facilities Industry 337

11.4 Food & Beverages Industry 337

11.5 Pulp & Paper Industry 338

11.6 Manufacturing Industry 338

Chapter 12 Market Forecast (2019-2027) 339

12.1 Global Odor Control System Sales (Unit), Revenue (Million USD), Market Share and Growth Rate (2019-2027) 339

12.1.1 Global Odor Control System Sales (Unit), Revenue (Million USD) and Share by Regions (2019-2027) 339

12.1.2 Global Odor Control System Sales (Unit) and Growth Rate (2019-2027) 347

12.1.3 North America Odor Control System Sales (Unit) and Growth Rate (2019-2027) 349

12.1.5 Europe Odor Control System Sales (Unit) and Growth Rate (2019-2027) 353

12.1.6 Asia Pacific Odor Control System Sales (Unit) and Growth Rate (2019-2027) 355

12.1.9 Middle East & Africa Odor Control System Sales (Unit) and Growth Rate (2019-2027) 361

12.1.10 South America Odor Control System Sales (Unit) and Growth Rate (2019-2027) 363

12.2 Global (2019-2024) Odor Control System Sales (Unit), Revenue (Million USD) by Type 367

12.2.1 Overall Market Performance 367

12.2.2 Chemical Odor Control Systems 370

12.2.3 Activated Odor Control Systems 372

12.2.4 Biological Odor Control Systems 374

12.3 Global (2019-2027) Odor Control System Sales (Unit), Revenue (Million USD) by Application 376

12.3.1 Overall Market Performance 376

12.3.2 Chemical Industry 380

12.3.3 Oil Refineries & Petrochemical Industry 381

12.3.4 Waste Treatment Facilities 382

12.3.5 Food & Beverages 383

12.3.6 Pulp & Paper Industry 384

12.3.7 Manufacturing 385

12.3.8 Others 386

12.4 Global Odor Control System Price (USD/Unit) 387

12.4.1 Global Odor Control System Price (USD/Unit) Trend 387

Chapter 13 Conclusion 388

1

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

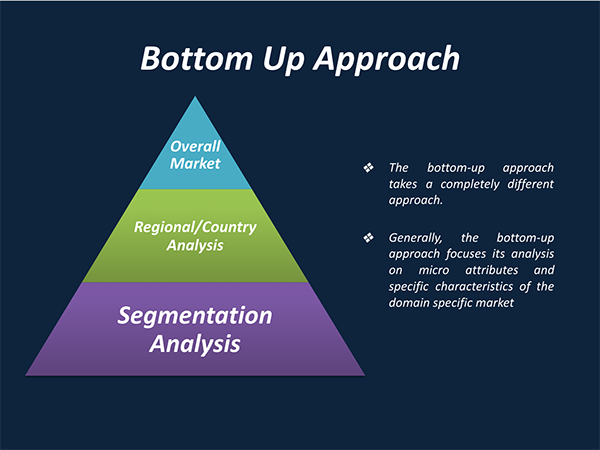

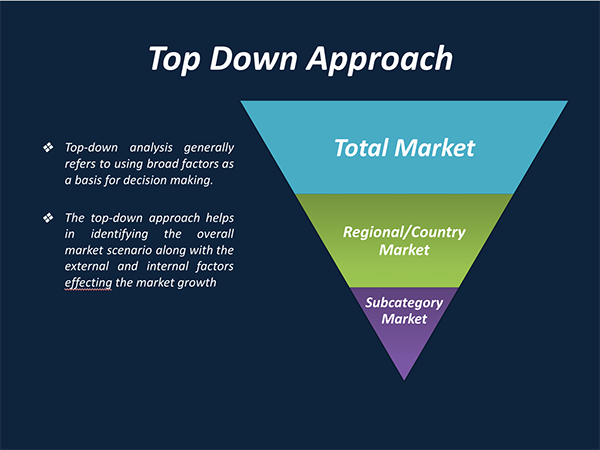

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

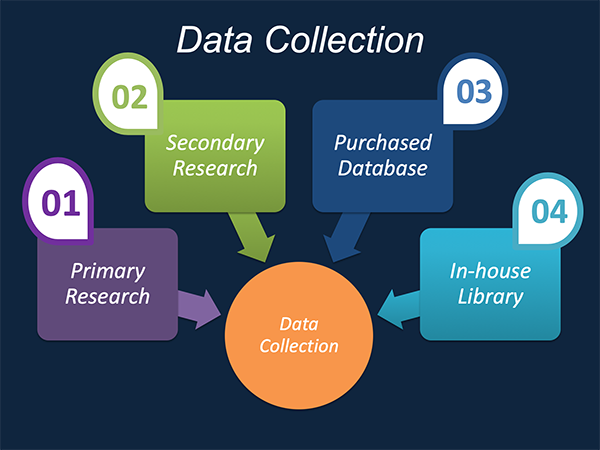

Our market research process involves with the four specific stages.

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.