The Global Optical Fiber Fusion Splicer Market is expected to grow from USD 625.92 Million in 2019 to USD 865.70 Million by 2027, at a CAGR of 4.14% during the forecast period 2020-2027.

Fusion Splicer is widely used to join two fibers together using heat. This is broadly used when the fiber is broken, or it is not long enough, and more length is required. Splicing fiber optical cables is a simple procedure in which fiber ends, which are needed to join, are placed in a splicer, where it is automatically aligned, and then fused together. This method is more reliable, with less light are scattered or reflected by the splice. The spliced fiber would be as strong as original optical fiber. The rising rate of internet penetration with Facebook, WhatsApp, and Instagram is driving the demand for bandwidths. The rising demand for bandwidths are propelling the optical fiber fusion splicer market. The telecommunication industry has covered a long distance; initially, it was voice dominated industry, but now the selling point is data. Also the advent of 5G telecommunications, are some of the factors that would drive the optical fusion splicer market. However, the optical fiber fusion splicers are very expensive, and the local network operators can’t afford to use it. This acts as a major restraint.

The global optical fiber fusion splicer market has been segmented on the basis of type, application, and region. Type segment includes Single Fiber Fusion Splicer, Ribbon Fiber Fusion Splicer, and Special Fiber Fusion Splicer. The single fiber fusion splicer segment held the largest market share of 52.25% in 2019. This owes to the rapid growth in the bandwidth demand, which drives the terrestrial and submarine cable network operators to upgrade their network. The application segment includes CATV, Telecom, Premises & Enterprise, Military, and Others. Telecom Industry held the largest market share of 54.36% in 2019. This owes the rising demand for smartphones, the concentration of selling point to data, and penetration of the internet. The global optical fiber fusion splicer market has been divided into North America, Europe, Asia Pacific, Middle East and Africa, and South America. Asia Pacific is accounted for the highest market share of 44.56% in 2019. Presence of a large telecommunication industry has come a long way from voice dominated industry to base on data.

The market for Optical Fiber Fusion Splicer market is segmented into key players. Major Player includes SEI, Fujikura, Furukawn, ILSINTECH, INNO, and others.

This study forecasts revenue growth at global, regional, and country levels from 2013 to 2027. Fior Markets has segmented the on the basis of below-mentioned segments:

Chapter 1 Introduction

1.1 Research Methodology

1.2 FMR Desk Research

1.2.1 FMR Data Synthesis

1.2.2 Data Validation and Market Feedback

1.2.3 FMR Data Sources

Chapter 2 Global Optical Fiber Fusion Splicer Market Overview

2.1 Optical Fiber Fusion Splicer Definition

2.2 Global Optical Fiber Fusion Splicer Market Size Status and Outlook (2013-2027)

2.3 Global Optical Fiber Fusion Splicer Market Size Comparison by Region (2013-2019)

2.4 Global Optical Fiber Fusion Splicer Sales (K Units) Comparison by Type (2013-2027)

2.5 Global Optical Fiber Fusion Splicer Sales (K Units) Comparison by Application (2013-2027)

2.6 Global Optical Fiber Fusion Splicer Market Size Comparison by Sales Channel (2013-2027)

2.7 Optical Fiber Fusion Splicer Market Dynamics

2.7.1 Market Drivers/Opportunities

2.7.1.1 High Demand for Increased Network Bandwidth

2.7.1.2 Increase in Government Funding for Fiber Optic Networks

2.7.1.3 Growth of the Telecommunications Industry

2.7.2 Market Challenges/Risks

2.7.2.1 High Cost of Equipment

2.7.2.2 Lack of Technical Knowledge and Skills

2.7.3 Market News (Mergers/Acquisitions/ Expansion)

Chapter 3 Optical Fiber Fusion Splicer Market Segment Analysis by Player

3.1 Global Optical Fiber Fusion Splicer Sales (K Units) and Market Share by Player (2016-2018)

3.2 Global Optical Fiber Fusion Splicer Revenue and Market Share by Player (2016-2018)

3.3 Global Optical Fiber Fusion Splicer Average Price by Player (2016-2018)

3.4 Players Competition Situation & Trends

3.5 Conclusion of Segment by Player

Chapter 4 Optical Fiber Fusion Splicer Market Segment Analysis by Type

4.1 Global Optical Fiber Fusion Splicer Market by Type

4.1.1 Single Fiber Fusion Splicer

4.1.1.1 Fixed V-groove (2 Motors)

4.1.1.2 Cladding Alignment (4 Motors)

4.1.1.3 Core-alignment (6 Motors)

4.1.2 Ribbon Fiber Fusion Splicer

4.1.3 Special Fiber Fusion Splicer

4.2 Global Optical Fiber Fusion Splicer Sales (K Units) and Market Share by Type (2013-2019)

4.3 Global Optical Fiber Fusion Splicer Revenue and Market Share by Type (2013-2019)

4.4 Global Optical Fiber Fusion Splicer Price (USD/Unit)

4.5 Global Optical Fiber Fusion Splicer Sales (K Units) and Market Share by Single Fiber Fusion Splicer (2013-2019)

4.6 Global Optical Fiber Fusion Splicer Revenue and Market Share by Single Fiber Fusion Splicer (2013-2019)

4.7 Conclusion of Segment by Type

Chapter 5 Optical Fiber Fusion Splicer Market Segment Analysis by Application

5.1 Global Optical Fiber Fusion Splicer Market by Application

5.1.1 CATV

5.1.2 Telecom

5.1.3 Premises & Enterprise

5.1.4 Military

5.1.5 Others

5.2 Global Optical Fiber Fusion Splicer Sales (K Units) and Market Share by Application (2013-2019)

5.3 Conclusion of Segment by Application

Chapter 6 Optical Fiber Fusion Splicer Market Segment Analysis by Sales Channel

6.1 Global Optical Fiber Fusion Splicer Market by Sales Channel

6.1.1 Direct Channel

6.1.2 Distribution Channel

6.2 Global Optical Fiber Fusion Splicer Sales (K Units) and Market Share by Sales Channel (2013-2019)

6.3 Conclusion of Segment by Sales Channel

Chapter 7 Optical Fiber Fusion Splicer Market Segment Analysis by Region

7.1 Global Optical Fiber Fusion Splicer Market Size and CAGR Overview by Region (2013-2019)

7.2 Global Optical Fiber Fusion Splicer Sales (K Units) and Market Share by Region (2013-2019)

7.3 Global Optical Fiber Fusion Splicer Revenue and Market Share by Region (2013-2019)

7.4 North America

7.4.1 North America Market by Country

7.4.2 North America Optical Fiber Fusion Splicer Market Share by Type

7.4.3 North America Optical Fiber Fusion Splicer Market Share by Application

7.4.4 United States

7.4.5 Canada

7.4.6 Mexico

7.5 Europe

7.5.1 Europe Market by Country

7.5.2 Europe Optical Fiber Fusion Splicer Market Share by Type

7.5.3 Europe Optical Fiber Fusion Splicer Market Share by Application

7.5.4 Germany

7.5.5 France

7.5.6 UK

7.5.7 Russia

7.5.8 Italy

7.5.9 Spain

7.5.10 Benelux

7.6 Asia-Pacific

7.6.1 Asia-Pacific Market by Country

7.6.2 Asia-Pacific Optical Fiber Fusion Splicer Market Share by Type

7.6.3 Asia-Pacific Optical Fiber Fusion Splicer Market Share by Application

7.6.4 China

7.6.5 Japan

7.6.6 India

7.6.7 South Korea

7.6.8 Australia

7.6.9 Southeast Asia

7.7 South America

7.7.1 South America Market by Country

7.7.2 South America Optical Fiber Fusion Splicer Market Share by Type

7.7.3 South America Optical Fiber Fusion Splicer Market Share by Application

7.7.4 Brazil

7.7.5 Argentina

7.7.6 Colombia

7.8 Middle East & Africa

7.8.1 Middle East & Africa Market by Country

7.8.2 Middle East & Africa Optical Fiber Fusion Splicer Market Share by Type

7.8.3 Middle East & Africa Optical Fiber Fusion Splicer Market Share by Application

7.8.4 Saudi Arabia

7.8.5 UAE

7.8.6 Egypt

7.8.7 Nigeria

7.8.8 South Africa

7.9 Conclusion of Segment by Region

Chapter 8 Profile of Leading Optical Fiber Fusion Splicer Players

8.1 Fujikura Ltd.

8.1.1 Company Snapshot

8.1.2 Product/Business Offered

8.1.3 Business Performance (Revenue, Gross Margin, and Market Share)

8.1.4 Strategy and SWOT Analysis

8.2 Sumitomo Electric Industries, Ltd.

8.2.1 Company Snapshot

8.2.2 Product/Business Offered

8.2.3 Business Performance (Revenue, Gross Margin, and Market Share)

8.2.4 Strategy and SWOT Analysis

8.3 Furukawa Electric Co., Ltd.

8.3.1 Company Snapshot

8.3.2 Product/Business Offered

8.3.3 Business Performance (Revenue, Gross Margin, and Market Share)

8.3.4 Strategy and SWOT Analysis

8.4 INNO Instrument Inc.

8.4.1 Company Snapshot

8.4.2 Product/Business Offered

8.4.3 Business Performance (Revenue, Gross Margin, and Market Share)

8.4.4 Strategy and SWOT Analysis

8.5 ILSINTECH Co., LTD.

8.5.1 Company Snapshot

8.5.2 Product/Business Offered

8.5.3 Business Performance (Revenue, Gross Margin, and Market Share)

8.5.4 Strategy and SWOT Analysis

8.6 China Electronics Technology Instruments Corporation. Ltd.

8.6.1 Company Snapshot

8.6.2 Product/Business Offered

8.6.3 Business Performance (Revenue, Gross Margin, and Market Share)

8.6.4 Strategy and SWOT Analysis

8.7 NanJing DVP O.E.TECH. CO., LTD.

8.7.1 Company Snapshot

8.7.2 Product/Business Offered

8.7.3 Strategy and SWOT Analysis

8.8 SKYCOM (Nanjing Tianxing Electronic Technology Co., Ltd.)

8.8.1 Company Snapshot

8.8.2 Product/Business Offered

8.8.3 Strategy and SWOT Analysis

8.9 Signal Fire Technology Co., Ltd.

8.9.1 Company Snapshot

8.9.2 Product/Business Offered

8.9.3 Strategy and SWOT Analysis

8.10 COMWAY Technology LLC

8.10.1 Company Snapshot

8.10.2 Product/Business Offered

8.10.3 Strategy and SWOT Analysis

8.11 Nanjing Jilong Optical Communication Co., Ltd

8.11.1 Company Snapshot

8.11.2 Product/Business Offered

8.11.3 Strategy and SWOT Analysis

8.12 GAO Tek Inc.

8.12.1 Company Snapshot

8.12.2 Product/Business Offered

8.12.3 Strategy and SWOT Analysis

8.13 Shanghai Xianghe Fiber Communication Co., Ltd.

8.13.1 Company Snapshot

8.13.2 Product/Business Offered

8.13.3 Strategy and SWOT Analysis

8.14 Greenlee Communications (Subsidiary of Emerson Electric Co.)

8.14.1 Company Snapshot

8.14.2 Product/Business Offered

8.14.3 Strategy and SWOT Analysis

8.15 Tianjin Eloik Communication Equipment Technology Co., Ltd.

8.15.1 Company Snapshot

8.15.2 Product/Business Offered

8.15.3 Strategy and SWOT Analysis

Chapter 9 Upstream and Downstream Analysis of Optical Fiber Fusion Splicer

9.1 Industrial Chain of Optical Fiber Fusion Splicer

9.2 Upstream of Optical Fiber Fusion Splicer

9.2.1 Raw Materials

9.2.2 Labor Cost

9.2.2.1 USA Labor Cost Analysis

9.3 Downstream of Optical Fiber Fusion Splicer

9.3.1 Leading Distributors/Dealers of Optical Fiber Fusion Splicer

9.3.2 Leading Consumers of Optical Fiber Fusion Splicer

Chapter 10 Development Trend of Optical Fiber Fusion Splicer (2020-2027)

10.1 Global Optical Fiber Fusion Splicer Market Size (Sales and Revenue) Forecast (2020-2027)

10.2 Global Optical Fiber Fusion Splicer Market Size and CAGR Forecast by Region (2020-2027)

10.3 Global Optical Fiber Fusion Splicer Market Size and CAGR Forecast by Type (2020-2027)

10.4 Global Optical Fiber Fusion Splicer Market Size and CAGR Forecast by Single Fiber Fusion Splicer (2020-2027)

10.5 Global Optical Fiber Fusion Splicer Market Size and CAGR Forecast by Application (2020-2027)

10.6 Global Optical Fiber Fusion Splicer Market Size and CAGR Forecast by Sales Channel (2020-2027)

Chapter 11 Conclusion

1

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

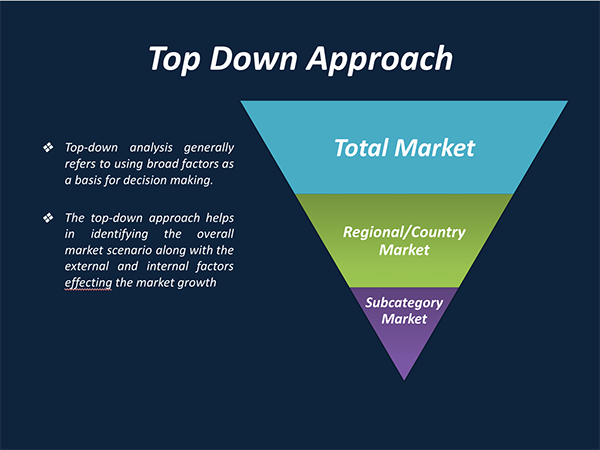

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

Our market research process involves with the four specific stages.

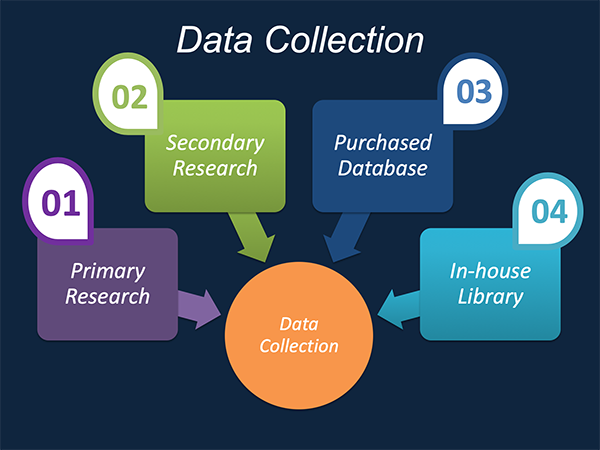

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

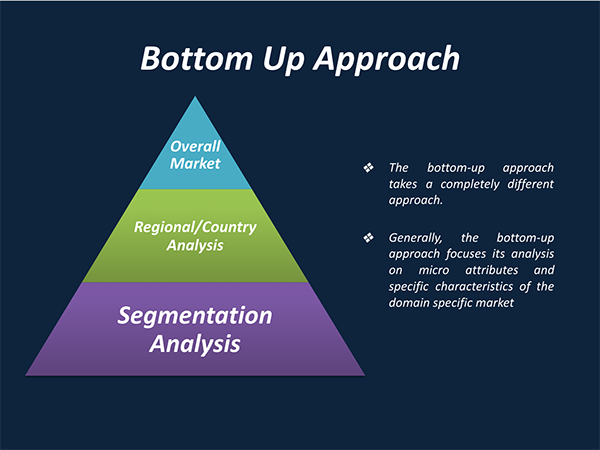

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.