The global sodium silicate market is expected to grow from USD 6.46 billion in 2019 to USD 8.85 billion by 2027, at a CAGR of 3.98% during the forecast period from 2020-2027. Sodium silicates are used in the textile industry with soaps, wetting agents, bleaches, and synthetic detergents, in operations, such as kier boiling, cleaning & finishing, wool scouring, bleaching, and degumming.

In addition to this, sodium silicate solutions have been used as ingredients in the drying process of the manufacturing of detergent powder for many years. Rising disposable incomes and changing consumer preference are pushing the growth of detergents and cleaning agents market, resulting in the growth of sodium silicate market.

Sodium silicate used as an additive enables to maintain effective pH level during cleaning operations, boosts the effectiveness of soaps and surfactants and detergency of cleaning products. However, health hazards and fluctuating raw material prices are some of the factors anticipated to hinder the market growth over the forecast period.

The market has been segmented on the basis of type, application, and region. The type segment includes sodium metasilicate and sodium silicate. Sodium silicate segment held largest market share of 61.45% and valued at USD 3.94 billion in 2019. Sodium silicate is also the technical and common name for a mixture of such compounds, chiefly the metasilicate, also called water glass, water glass, or liquid glass. The product has a wide variety of uses, including the formulation of cements, passive fire protection, textile and lumber processing, manufacture of refractory ceramics, as adhesives, and in the production of silica gel.

The application segment includes surface coatings, adhesive, detergent and others. Detergent segment held the largest market share of 39.64% in 2019. The food and beverage processing requires the sodium silicate for the cooling process. Detergents are used in cleaning household surfaces, dishes and washing laundry. Sodium silicate is a building agent used in many commercial detergents. The purpose of the sodium silicate to be prevent mineral deposits on surfaces after washing by removing water hardness.

The market has been divided into North America, Europe, Asia-Pacific, South America and Middle East and Africa. Asia-Pacific held the largest market share of 44.70% in 2019. The rise in production of specialty silica in various countries of Asia Pacific region is driving the growth sodium silicate market.

Key players in the Sodium silicate market are PQ Corporation, PPG Industries, Inc., W. R. Grace & Co., Nippon Chemical Industrial Co., Ltd., Tokuyama Corporation, Evonik Industries AG, BASF SE, and Oriental Silicas Corporation. Developing and developed countries are offering greater opportunities and major players are continuously focused on new developments, strategic partnerships, acquisitions and venture capital investments to obtain high growth in the market. In May 2018, PQ Corporation and Brenntag Group, the global market leader in chemical distribution, announced that Brenntag is distributing PQ’s sodium and potassium silicate solutions in France.

This study forecasts revenue growth at global, regional, and country levels from 2014 to 2027. Fior Markets has segmented the on the basis of below mentioned segments:

Chapter 1 Introduction 22

1.1 Research Methodology 22

1.2 FMR desk research 23

1.2.1 FMR data synthesis 24

1.2.2 Data validation and market feedback 24

1.2.3 FMR data sources 25

Chapter 2 Executive Summary 27

2.1 World Market Overview 27

2.1.1 Global Sodium Silicate Consumption 2014-2027 29

2.1.2 Sodium Silicate Consumption CAGR by Region 31

2.2 Sodium Silicate Consumption Segment by Type 33

2.2.1 Sodium Metasilicate 33

2.2.2 Sodium Silicate 34

2.3 Sodium Silicate Consumption by Type 35

2.3.1 Global Sodium Silicate Consumption Market Share by Type (2014-2019) 35

2.3.2 Global Sodium Silicate Consumption Revenue Market Share by Type (2014-2019) 37

2.3.3 Global Sodium Silicate Consumption Price by Type (2014-2019) 39

2.4 Sodium Silicate Consumption Segment by Application 40

2.4.1 Surface Coatings 40

2.4.2 Adhesive 42

2.4.3 Detergent 44

2.4.4 Others 45

2.5 Sodium Silicate Consumption by Application 47

2.5.1 Global Sodium Silicate Consumption Market Share by Application (2014-2019) 47

2.5.2 Global Sodium Silicate Consumption Revenue Market Share by Application (2014-2019) 50

Chapter 3 Global Sodium Silicate Consumption by Company 53

3.1 Global Sodium Silicate Consumption Market Share by Company 53

3.1.1 Global Sodium Silicate Consumption by Company (2017-2019) 53

3.1.2 Sodium Silicate Consumption Market Share by Manufacturers 54

3.2 Global Sodium Silicate Consumption Revenue Market Share by Company 56

3.2.1 Global Sodium Silicate Consumption Revenue by Manufacturers 56

3.2.2 Sodium Silicate Consumption Revenue Market Share by Manufacturers 57

3.3 Global Sodium Silicate Consumption Price by Manufacturers 59

3.4 Sodium Silicate Consumption Manufacturers Manufacturing Base Distribution, Headquarters 60

3.4.1 Key Manufacturers Sodium Silicate Consumption Product Location Distribution 60

3.5 Manufacturers Mergers & Acquisitions, Expansion Plans 61

Chapter 4 Sodium Silicate Consumption by Region 63

4.1 Sodium Silicate Consumption by Region 63

4.1.1 Global Sodium Silicate Consumption Market Share by Region (2014-2019) 63

4.1.2 Global Sodium Silicate Consumption Revenue Market Share by Region (2014-2019) 65

4.2 North Americas Sodium Silicate Consumption Growth 67

4.3 APAC Sodium Silicate Consumption Growth 69

4.4 Europe Sodium Silicate Consumption Growth 71

4.5 Central & South America Sodium Silicate Consumption Growth 73

4.6 Middle East & Africa Sodium Silicate Consumption Growth 75

Chapter 5 North America 77

5.1 North America Sodium Silicate Consumption by Countries 77

5.1.1 North America Sodium Silicate Consumption by Countries 77

5.1.2 North America Sodium Silicate Consumption Revenue by Countries 79

5.2 North America Sodium Silicate Consumption by Type 81

5.2.1 North America Sodium Silicate Consumption by Type 81

5.3 North America Sodium Silicate Consumption by Application 83

5.3.1 North America Sodium Silicate Consumption by Application 83

5.4 United States 85

5.5 Canada 87

5.6 Mexico 89

Chapter 6 Central & South America 91

6.1 South America Sodium Silicate Consumption by Countries 91

6.1.1 South America Sodium Silicate Consumption by Countries 91

6.1.2 South America Sodium Silicate Consumption Revenue by Countries 93

6.2 South America Sodium Silicate Consumption by Type 95

6.2.1 South America Sodium Silicate Consumption by Type 95

6.3 South America Sodium Silicate Consumption by Application 97

6.3.1 South America Sodium Silicate Consumption by Application 97

6.4 Brazil 100

6.5 Rest of SA 102

Chapter 7 APAC 104

7.1 APAC Sodium Silicate Consumption by Countries 104

7.1.1 APAC Sodium Silicate Consumption by Countries 104

7.1.2 APAC Sodium Silicate Consumption Revenue by Countries 107

7.2 APAC Sodium Silicate Consumption by Type 110

7.2.1 APAC Sodium Silicate Consumption by Type 110

7.3 APAC Sodium Silicate Consumption by Application 112

7.3.1 APAC Sodium Silicate Consumption by Application 112

7.4 China 114

7.5 Japan 116

7.6 Korea 118

7.7 Southeast Asia 120

7.8 India 122

7.9 Australia 124

7.10 Pakistan 126

Chapter 8 Europe 128

8.1 Europe Sodium Silicate Consumption by Countries 128

8.1.1 Europe Sodium Silicate Consumption by Countries 128

8.1.2 Europe Sodium Silicate Consumption Revenue by Countries 130

8.2 Europe Sodium Silicate Consumption by Type 132

8.2.1 Europe Sodium Silicate Consumption by Type 132

8.3 Europe Sodium Silicate Consumption by Application 134

8.3.1 Europe Sodium Silicate Consumption by Application 134

8.4 Germany 136

8.5 France 138

8.6 UK 140

8.7 Italy 142

8.8 Russia 144

Chapter 9 Middle East & Africa 146

9.1 Middle East & Africa Sodium Silicate Consumption by Countries 146

9.1.1 Middle East & Africa Sodium Silicate Consumption by Countries 146

9.1.2 Middle East & Africa Sodium Silicate Consumption Revenue by Countries 149

9.2 Middle East & Africa Sodium Silicate Consumption by Type 151

9.2.1 Middle East & Africa Sodium Silicate Consumption by Type 151

9.3 Middle East & Africa Sodium Silicate Consumption by Application 153

9.3.1 Middle East & Africa Sodium Silicate Consumption by Application 153

9.4 Egypt 156

9.5 South Africa 158

9.6 Israel 160

9.7 GCC Countries 162

Chapter 10 Market Drivers, Challenges and Trends 164

10.1 Market Drivers and Impact 164

10.1.1 Growing Demand from Key Regions 164

10.1.2 Growing Demand from Key Applications and Potential Industries 165

10.2 Market Challenges and Impact 166

10.3 Market Trends 166

Chapter 11 Marketing, Distributors and Customer 167

11.1 Marketing Channel 167

11.1.1 Direct Marketing 168

11.1.2 Indirect Marketing 170

11.1 Market Positioning 170

11.1.1 Marketing Channel Future Trend 171

11.1.2 Pricing Strategy 172

11.1.3 Brand Strategy 174

11.2 Distributors/Traders List 176

Chapter 12 Global Sodium Silicate Consumption Market Forecast 177

12.1 Global Sodium Silicate Consumption Forecast (2019-2027) 177

12.2 Global Sodium Silicate Consumption Forecast by Region 179

12.2.1 Global Sodium Silicate Consumption Forecast Market Share by Region (2019-2027) 179

12.2.2 Global Sodium Silicate Consumption Revenue Forecast Market Share by Region (2019-2027) 180

12.2.3 North Americas Consumption Forecast 181

12.2.4 APAC Consumption Forecast 183

12.2.5 Europe Consumption Forecast 185

12.2.6 Central & South America Consumption Forecast 187

12.2.7 Middle East & Africa Consumption Forecast 189

12.3 Americas Forecast by Country 191

12.3.1 United States Market Forecast 191

12.3.2 Canada Market Forecast 193

12.3.3 Mexico Market Forecast 195

12.4 Central & South America 197

12.4.1 Brazil Market Forecast 197

12.4.2 Rest of SA Market Forecast 199

12.5 APAC Forecast by Country 201

12.5.1 China Market Forecast 201

12.5.2 Japan Market Forecast 203

12.5.3 Korea Market Forecast 205

12.5.4 Southeast Asia Market Forecast 207

12.5.5 India Market Forecast 209

12.5.6 Australia Market Forecast 211

12.5.7 Pakistan Market Forecast 213

12.6 Europe Forecast by Country 215

12.6.1 Germany Market Forecast 215

12.6.2 France Market Forecast 217

12.6.3 UK Market Forecast 219

12.6.4 Italy Market Forecast 221

12.6.5 Russia Market Forecast 223

12.7 Middle East & Africa Forecast by Country 225

12.7.1 Egypt Market Forecast 225

12.7.2 South Africa Market Forecast 227

12.7.3 Israel Market Forecast 229

12.7.4 GCC Countries Market Forecast 231

12.8 Global Sodium Silicate Consumption Forecast by Type 233

12.8.1 Global Sodium Silicate Consumption Forecast Market Share by Type (2019-2027) 233

12.8.2 Global Sodium Silicate Consumption Revenue Forecast Market Share by Type (2019-2027) 234

12.9 Global Sodium Silicate Consumption Forecast by Application 235

12.9.1 Global Sodium Silicate Consumption Forecast Market Share by Application (2019-2027) 235

12.9.2 Global Sodium Silicate Consumption Revenue Forecast Market Share by Application (2019-2027) 237

Chapter 13 Key Players Analysis 238

13.1 PQ Corporation 238

13.1.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 238

13.1.2 Sodium Silicate Product Category, End Uses and Specification of PQ Corporation 240

13.1.3 PQ Corporation Sodium Silicate Sales, Revenue, Price, Gross Margin and Market Share (2013-2018) 241

13.1.4 Main Business/Business Overview 241

13.1.5 Recent Development 241

13.2 PPG Industries, Inc. 242

13.2.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 242

13.2.2 Sodium Silicate Product Category, End Uses and Specification of PPG Industries, Inc. 243

13.2.3 PPG Industries, Inc. Sodium Silicate Sales, Revenue, Price, Gross Margin and Market Share (2013-2018) 244

13.2.4 Main Business/Business Overview 245

13.2.5 Recent Development 245

13.3 W. R. Grace & Co. 246

13.3.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 246

13.3.2 Sodium Silicate Product Category, End Uses and Specification of W. R. Grace & Co. 247

13.3.3 Main Business/Business Overview 247

13.3.4 Recent Development 248

13.4 Nippon Chemical Industrial Co., Ltd. 249

13.4.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 249

13.4.2 Sodium Silicate Product Category, End Uses and Specification of Nippon Chemical Industrial Co., Ltd. 250

13.4.3 Nippon Chemical Industrial Co., Ltd. Sodium Silicate Sales, Revenue, Price, Gross Margin and Market Share (2013-2018) 251

13.4.4 Main Business/Business Overview 251

13.4.5 Recent Development 252

13.5 Tokuyama Corporation 253

13.5.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 253

13.5.2 Sodium Silicate Product Category, End Uses and Specification of Tokuyama Corporation 254

13.5.3 Tokuyama Corporation Sodium Silicate Sales, Revenue, Price, Gross Margin and Market Share (2013-2018) 255

13.5.4 Main Business/Business Overview 255

13.6 Evonik Industries AG 257

13.6.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 257

13.6.2 Sodium Silicate Product Category, End Uses and Specification of Evonik Industries AG 258

13.6.3 Evonik Industries AG Sodium Silicate Sales, Revenue, Price, Gross Margin and Market Share (2013-2018) 259

13.6.4 Main Business/Business Overview 259

13.6.5 Recent Development 260

13.7 BASF SE 261

13.7.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 261

13.7.2 Sodium Silicate Product Category, End Uses and Specification of BASF SE 262

13.7.3 BASF SE Sodium Silicate Sales, Revenue, Price, Gross Margin and Market Share (2013-2018) 262

13.7.4 Main Business/Business Overview 263

13.8 Oriental Silicas Corporation 264

13.8.1 Company Basic Information, Manufacturing Base, Sales Area and Its Competitors 264

13.8.2 Sodium Silicate Product Category, End Uses and Specification of Oriental Silicas Corporation 265

13.8.3 Main Business/Business Overview 265

Chapter 14 Research Findings and Conclusion 266

List of Figures

FIG. 1 Product Picture of Global Sodium Silicate Consumption 28

FIG. 2 Global Sodium Silicate Consumption Growth Rate 2014-2027 (Kilo Tons) 29

FIG. 3 Global Sodium Silicate Consumption Value Growth Rate 2014-2027 (USD millions) 30

FIG. 4 Global Sodium Silicate Consumption by Region 2019- 2027 (USD millions) 32

FIG. 5 Global Sodium Silicate Consumption Market Share by Type in 2018 36

FIG. 6 Global Sodium Silicate Consumption Revenue Market Share by Type 2018 38

FIG. 7 Global Sodium Silicate Consumption Market: Surface Coatings (2014-2019) (Kilo Tons) 41

FIG. 8 Global Sodium Silicate Consumption Market: Adhesive (2014-2019) (Kilo Tons) 43

FIG. 9 Global Sodium Silicate Consumption Market: Detergent (2014-2019) (Kilo Tons) 44

FIG. 10 Global Sodium Silicate Consumption Market: Other Industry (2014-2019) (Kilo Tons) 46

FIG. 11 Global Sodium Silicate Consumption Market Share by Application in 2018 49

FIG. 12 Global Sodium Silicate Consumption Revenue Market Share by Application (2014-2019) 52

FIG. 13 Global Sodium Silicate Consumption Share by Manufacturers in 2018 55

FIG. 14 Global Sodium Silicate Consumption Revenue Share by Manufacturers in 2018 58

FIG. 15 Global Sodium Silicate Consumption Market Share by Region in 2018 64

FIG. 16 Global Sodium Silicate Consumption Revenue Market Share by Region (2014-2019) 66

FIG. 17 North America Sodium Silicate Consumption Growth Rate 2014-2019 (Kilo Tons) 67

FIG. 18 North America Sodium Silicate Consumption Revenue Growth Rate 2014-2019 (Million USD) 68

FIG. 19 APAC Sodium Silicate Consumption Growth Rate 2014-2019 (Kilo Tons) 69

FIG. 20 APAC Sodium Silicate Consumption Revenue Growth Rate 2014-2019 (Million USD) 70

FIG. 21 Europe Sodium Silicate Consumption Growth Rate 2014-2019 (Kilo Tons) 71

FIG. 22 Europe Sodium Silicate Consumption Revenue Growth Rate 2014-2019 (Million USD) 72

FIG. 23 Central & South America Sodium Silicate Consumption Growth Rate 2014-2019 (Kilo Tons) 73

FIG. 24 Central & South America Sodium Silicate Consumption Revenue Growth Rate 2014-2019 (Million USD) 74

FIG. 25 Middle East & Africa Sodium Silicate Consumption Growth Rate 2014-2019 (Kilo Tons) 75

FIG. 26 Middle East & Africa Sodium Silicate Consumption Revenue Growth Rate 2014-2019 (Million USD) 76

FIG. 27 North America Sodium Silicate Consumption Market Share by Countries in 2018 78

FIG. 28 North America Sodium Silicate Consumption Revenue Market Share by Countries in 2018 80

FIG. 29 North America Sodium Silicate Consumption Market Share by Type in 2018 82

FIG. 30 North America Sodium Silicate Consumption Market Share by Application in 2018 84

FIG. 31 United States Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 85

FIG. 32 United States Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 86

FIG. 33 Canada Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 87

FIG. 34 Canada Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 88

FIG. 35 Mexico Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 89

FIG. 36 Mexico Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 90

FIG. 37 South America Sodium Silicate Consumption Market Share by Countries in 2018 92

FIG. 38 South America Sodium Silicate Consumption Revenue Market Share by Countries in 2018 94

FIG. 39 South America Sodium Silicate Consumption Market Share by Type in 2018 96

FIG. 40 South America Sodium Silicate Consumption Market Share by Application in 2018 99

FIG. 41 Brazil Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 100

FIG. 42 Brazil Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 101

FIG. 43 Rest of SA Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 102

FIG. 44 Rest of SA Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 103

FIG. 45 APAC Sodium Silicate Consumption Market Share by Countries in 2018 106

FIG. 46 APAC Sodium Silicate Consumption Revenue Market Share by Countries in 2018 109

FIG. 47 APAC Sodium Silicate Consumption Market Share by Type in 2018 111

FIG. 48 APAC Sodium Silicate Consumption Market Share by Application in 2018 113

FIG. 49 China Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 114

FIG. 50 China Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 115

FIG. 51 Japan Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 116

FIG. 52 Japan Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 117

FIG. 53 Korea Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 118

FIG. 54 Korea Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 119

FIG. 55 Southeast Asia Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 120

FIG. 56 Southeast Asia Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 121

FIG. 57 India Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 122

FIG. 58 India Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 123

FIG. 59 Australia Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 124

FIG. 60 Australia Asia Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 125

FIG. 61 Pakistan Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 126

FIG. 62 Pakistan Asia Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 127

FIG. 63 Europe Sodium Silicate Consumption Market Share by Countries in 2018 129

FIG. 64 Europe Sodium Silicate Consumption Revenue Market Share by Countries in 2018 131

FIG. 65 Europe Sodium Silicate Consumption Market Share by Type in 2018 133

FIG. 66 Europe Sodium Silicate Consumption Market Share by Application in 2018 135

FIG. 67 Germany Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 136

FIG. 68 Germany Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 137

FIG. 69 France Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 138

FIG. 70 France Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 139

FIG. 71 UK Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 140

FIG. 72 UK Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 141

FIG. 73 Italy Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 142

FIG. 74 Italy Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 143

FIG. 75 Russia Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 144

FIG. 76 Russia Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 145

FIG. 77 Middle East & Africa Sodium Silicate Consumption Market Share by Countries in 2018 148

FIG. 78 Middle East & Africa Sodium Silicate Consumption Revenue Market Share by Countries in 2018 150

FIG. 79 Middle East & Africa Sodium Silicate Consumption Market Share by Type in 2018 152

FIG. 80 Middle East & Africa Sodium Silicate Consumption Market Share by Application in 2018 155

FIG. 81 Egypt Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 156

FIG. 82 Egypt Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 157

FIG. 83 South Africa Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 158

FIG. 84 South Africa Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 159

FIG. 85 Israel Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 160

FIG. 86 Israel Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 161

FIG. 87 GCC Countries Sodium Silicate Consumption Growth Rate (2014-2019) (Kilo Tons) 162

FIG. 88 GCC Countries Sodium Silicate Consumption Revenue Growth Rate (2014-2019) (USD Million) 163

FIG. 89 Marketing Channels 167

FIG. 90 Direct Marketing 169

FIG. 91 Indirect Marketing 170

FIG. 92 Marketing Channel 172

FIG. 93 Pricing Strategy 174

FIG. 94 Brand Strategy 175

FIG. 95 Global Sodium Silicate Consumption Growth Rate Forecast (2019-2027) (Kilo Tons) 177

FIG. 96 Global Sodium Silicate Consumption Value Growth Rate Forecast (2019-2027) (USD Million) 178

FIG. 97 North Americas Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons)) 181

FIG. 98 North Americas Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 182

FIG. 99 APAC Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 183

FIG. 100 APAC Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 184

FIG. 101 Europe Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 185

FIG. 102 Europe Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 186

FIG. 103 Central & South America Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 187

FIG. 104 Central & South America Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 188

FIG. 105 Middle East & Africa Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons)) 189

FIG. 106 Middle East & Africa Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 190

FIG. 107 United States Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons)) 191

FIG. 108 United States Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 192

FIG. 109 Canada Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons)) 193

FIG. 110 Canada Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 194

FIG. 111 Mexico Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons)) 195

FIG. 112 Mexico Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 196

FIG. 113 Brazil Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons)) 197

FIG. 114 Brazil Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 198

FIG. 115 Rest of SA Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 199

FIG. 116 Rest of SA Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 200

FIG. 117 China Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 201

FIG. 118 China Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 202

FIG. 119 Japan Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 203

FIG. 120 Japan Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 204

FIG. 121 Korea Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 205

FIG. 122 Korea Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 206

FIG. 123 Southeast Asia Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 207

FIG. 124 Southeast Asia Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 208

FIG. 125 India Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 209

FIG. 126 India Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 210

FIG. 127 Australia Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 211

FIG. 128 Australia Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 212

FIG. 129 Pakistan Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 213

FIG. 130 Pakistan Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 214

FIG. 131 Germany Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 215

FIG. 132 Germany Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 216

FIG. 133 France Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 217

FIG. 134 France Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 218

FIG. 135 UK Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 219

FIG. 136 UK Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 220

FIG. 137 Italy Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 221

FIG. 138 Italy Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 222

FIG. 139 Russia Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 223

FIG. 140 Russia Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 224

FIG. 141 Egypt Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 225

FIG. 142 Egypt Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 226

FIG. 143 South Africa Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 227

FIG. 144 South Africa Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 228

FIG. 145 Israel Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 229

FIG. 146 Israel Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 230

FIG. 147 GCC Countries Sodium Silicate Consumption Forecast 2019-2027 (Kilo Tons) 231

FIG. 148 GCC Countries Sodium Silicate Consumption Value Forecast 2019-2027 (USD millions) 232

List of Tables

TABLE 1 Global Sodium Silicate Consumption CAGR by Region 2014-2027 (USD millions) 31

TABLE 2 Global Sodium Silicate Consumption by Type (2014-2019) 35

TABLE 3 Global Sodium Silicate Consumption Market Share by Type (2014-2019) 35

TABLE 4 Global Sodium Silicate Consumption Revenue by Type (2014-2019) 37

TABLE 5 Global Sodium Silicate Consumption Revenue Market Share by Type (2014-2019) 37

TABLE 6 Global Sodium Silicate Consumption Price by Type (2014-2019) 39

TABLE 7 Global Sodium Silicate Consumption by Application (2014-2019) 47

TABLE 8 Global Sodium Silicate Consumption Market Share by Application (2014-2019) 48

TABLE 9 Global Sodium Silicate Consumption Revenue by Application (2014-2019) 50

TABLE 10 Global Sodium Silicate Consumption Revenue Market Share by Application (2014-2019) 51

TABLE 11 Global Sodium Silicate Consumption by Company (2017-2019) (Kilo Tons) 53

TABLE 12 Global Sodium Silicate Consumption Share by Manufacturers (2017-2019) 54

TABLE 13 Global Sodium Silicate Consumption Revenue by Manufacturers (2017-2019) (USD Mn) 56

TABLE 14 Global Sodium Silicate Consumption Revenue Share by Manufacturers (2017-2019) 57

TABLE 15 Global Sodium Silicate Consumption Sale Price by Company (2017-2019) 59

TABLE 16 Sodium Silicate Consumption Manufacturers Manufacturing Base Distribution and Headquarters 60

TABLE 17 Table Manufacturers Mergers & Acquisitions, Expansion Plans 61

TABLE 18 Global Sodium Silicate Consumption by Region (2014-2019) 63

TABLE 19 Global Sodium Silicate Consumption Market Share by Region (2014-2019) 64

TABLE 20 Global Sodium Silicate Consumption Revenue by Region (2014-2019) 65

TABLE 21 Global Sodium Silicate Consumption Revenue Market Share by Region (2014-2019) 65

TABLE 22 North America Sodium Silicate Consumption by Countries (2014-2019) (Kilo Tons) 77

TABLE 23 North America Sodium Silicate Consumption Market Share by Countries (2014-2019) 77

TABLE 24 North America Sodium Silicate Consumption Revenue by Countries (2014-2019) (USD Million) 79

TABLE 25 North America Sodium Silicate Consumption Revenue Market Share by Countries (2014-2019) 79

TABLE 26 North America Sodium Silicate Consumption by Type (2014-2019) (Kilo Tons) 81

TABLE 27 North America Sodium Silicate Consumption Market Share by Type (2014-2019) 81

TABLE 28 North America Sodium Silicate Consumption by Application (2014-2019) (Kilo Tons) 83

TABLE 29 North America Sodium Silicate Consumption Market Share by Application (2014-2019) 84

TABLE 30 South America Sodium Silicate Consumption by Countries (2014-2019) (Kilo Tons) 91

TABLE 31 South America Sodium Silicate Consumption Market Share by Countries (2014-2019) 91

TABLE 32 South America Sodium Silicate Consumption Revenue by Countries (2014-2019) (USD Million) 93

TABLE 33 South America Sodium Silicate Consumption Revenue Market Share by Countries (2014-2019) 93

TABLE 34 South America Sodium Silicate Consumption by Type (2014-2019) (Kilo Tons) 95

TABLE 35 South America Sodium Silicate Consumption Market Share by Type (2014-2019) 95

TABLE 36 South America Sodium Silicate Consumption by Application (2014-2019) (Kilo Tons) 97

TABLE 37 South America Sodium Silicate Consumption Market Share by Application (2014-2019) 98

TABLE 38 APAC Sodium Silicate Consumption by Countries (2014-2019) (Kilo Tons) 104

TABLE 39 APAC Sodium Silicate Consumption Market Share by Countries (2014-2019) 105

TABLE 40 APAC Sodium Silicate Consumption Revenue by Countries (2014-2019) (USD Million) 107

TABLE 41 APAC Sodium Silicate Consumption Revenue Market Share by Countries (2014-2019) 108

TABLE 42 APAC Sodium Silicate Consumption by Type (2014-2019) (Kilo Tons) 110

TABLE 43 APAC Sodium Silicate Consumption Market Share by Type (2014-2019) 110

TABLE 44 APAC Sodium Silicate Consumption by Application (2014-2019) (Kilo Tons) 112

TABLE 45 APAC Sodium Silicate Consumption Market Share by Application (2014-2019) 112

TABLE 46 Europe Sodium Silicate Consumption by Countries (2014-2019) (Kilo Tons) 128

TABLE 47 Europe Sodium Silicate Consumption Market Share by Countries (2014-2019) 129

TABLE 48 Europe Sodium Silicate Consumption Revenue by Countries (2014-2019) (USD Million) 130

TABLE 49 Europe Sodium Silicate Consumption Revenue Market Share by Countries (2014-2019) 131

TABLE 50 Europe Sodium Silicate Consumption by Type (2014-2019) (Kilo Tons) 132

TABLE 51 Europe Sodium Silicate Consumption Market Share by Type (2014-2019) 132

TABLE 52 Europe Sodium Silicate Consumption by Application (2014-2019) (Kilo Tons) 134

TABLE 53 Europe Sodium Silicate Consumption Market Share by Application (2014-2019) 134

TABLE 54 Middle East & Africa Sodium Silicate Consumption by Countries (2014-2019) (Kilo Tons) 146

TABLE 55 Middle East & Africa Sodium Silicate Consumption Market Share by Countries (2014-2019) 147

TABLE 56 Middle East & Africa Sodium Silicate Consumption Revenue by Countries (2014-2019) (USD Million) 149

TABLE 57 Middle East & Africa Sodium Silicate Consumption Revenue Market Share by Countries (2014-2019) 150

TABLE 58 Middle East & Africa Sodium Silicate Consumption by Type (2014-2019) (Kilo Tons) 151

TABLE 59 Middle East & Africa Sodium Silicate Consumption Market Share by Type (2014-2019) 151

TABLE 60 Middle East & Africa Sodium Silicate Consumption by Application (2014-2019) (Kilo Tons) 153

TABLE 61 Middle East & Africa Sodium Silicate Consumption Market Share by Application (2014-2019) 154

TABLE 62 Key and Potential Regions of Sodium Silicate Consumption 164

TABLE 63 Key Applications and Potential Industries of Sodium Silicate Consumption 165

TABLE 64 Market Challenges and Impact 166

TABLE 65 Market Trends 166

TABLE 66 Distributors/Traders List 176

TABLE 67 Global Sodium Silicate Consumption Forecast by Region (2019-2027) 179

TABLE 68 Global Sodium Silicate Consumption Forecast Market Share by Region (2019-2027) 179

TABLE 69 Global Sodium Silicate Consumption Revenue Forecast by Region (2019-2027) 180

TABLE 70 Global Sodium Silicate Consumption Revenue Forecast Market Share by Region (2019-2027) 180

TABLE 71 Global Sodium Silicate Consumption Forecast by Type (2019-2027) 233

TABLE 72 Global Sodium Silicate Consumption Forecast Market Share by Type (2019-2027) 233

TABLE 73 Global Sodium Silicate Consumption Revenue Forecast by Type (2019-2027) 234

TABLE 74 Global Sodium Silicate Consumption Revenue Forecast Market Share by Type (2019-2027) 234

TABLE 75 Global Sodium Silicate Consumption Forecast by Application (2019-2027) 235

TABLE 76 Global Sodium Silicate Consumption Forecast Market Share by Application (2019-2027) 236

TABLE 77 Global Sodium Silicate Consumption Revenue Forecast by Application (2019-2027) 237

TABLE 78 Global Sodium Silicate Consumption Revenue Forecast Market Share by Application (2019-2027) 237

TABLE 79 PQ Corporation Basic Information, Manufacturing Base, Sales Area and Its Competitors 238

TABLE 80 Representative Sodium Silicate Product of PQ Corporation 240

TABLE 81 PQ Corporation Sodium Silicate Sales (K Ton), Revenue (Million USD), Price (USD/Ton) and Gross Margin (2013-2018) 241

TABLE 82 PPG Industries, Inc. Basic Information, Manufacturing Base, Sales Area and Its Competitors 242

TABLE 83 Representative Sodium Silicate Product of PPG Industries, Inc. 243

TABLE 84 PPG Industries, Inc. Sodium Silicate Sales (K Ton), Revenue (Million USD), Price (USD/Ton) and Gross Margin (2013-2018) 244

TABLE 85 W. R. Grace & Co. Basic Information, Manufacturing Base, Sales Area and Its Competitors 246

TABLE 86 Representative Sodium Silicate Product of W. R. Grace & Co. 247

TABLE 87 Nippon Chemical Industrial Co., Ltd. Basic Information, Manufacturing Base, Sales Area and Its Competitors 249

TABLE 88 Representative Sodium Silicate Product of Nippon Chemical Industrial Co., Ltd. 250

TABLE 89 Nippon Chemical Industrial Co., Ltd. Sodium Silicate Sales (K Ton), Revenue (Million USD), Price (USD/Ton) and Gross Margin (2013-2018) 251

TABLE 90 Tokuyama Corporation Basic Information, Manufacturing Base, Sales Area and Its Competitors 253

TABLE 91 Representative Sodium Silicate Product of Tokuyama Corporation 254

TABLE 92 Tokuyama Corporation Sodium Silicate Sales (K Ton), Revenue (Million USD), Price (USD/Ton) and Gross Margin (2013-2018) 255

TABLE 93 Evonik Industries AG Basic Information, Manufacturing Base, Sales Area and Its Competitors 257

TABLE 94 Representative Sodium Silicate Product of Evonik Industries AG 258

TABLE 95 Evonik Industries AG Sodium Silicate Sales (K Ton), Revenue (Million USD), Price (USD/Ton) and Gross Margin (2013-2018) 259

TABLE 96 BASF SE Basic Information, Manufacturing Base, Sales Area and Its Competitors 261

TABLE 97 Representative Sodium Silicate Product of BASF SE 262

TABLE 98 BASF SE Sodium Silicate Sales (K Ton), Revenue (Million USD), Price (USD/Ton) and Gross Margin (2013-2018) 262

TABLE 99 Oriental Silicas Corporation Basic Information, Manufacturing Base, Sales Area and Its Competitors 264

TABLE 100 Representative Sodium Silicate Product of Oriental Silicas Corporation 265

Market research is a method of gathering, assessing and deducing data & information about a particular market. Market research is very crucial in these days. The techniques analyze about how a product/service can be offered to the market to its end-customers, observe the impact of that product/service based on the past customer experiences, and cater their needs and demands. Owing to the successful business ventures, accurate, relevant and thorough information is the base for all the organizations because market research report/study offers specific market related data & information about the industry growth prospects, perspective of the existing customers, and the overall market scenario prevailed in past, ongoing present and developing future. It allows the stakeholders and investors to determine the probability of a business before committing substantial resources to the venture. Market research helps in solving the marketing issues challenges that a business will most likely face.

Market research is valuable because of the following reasons:

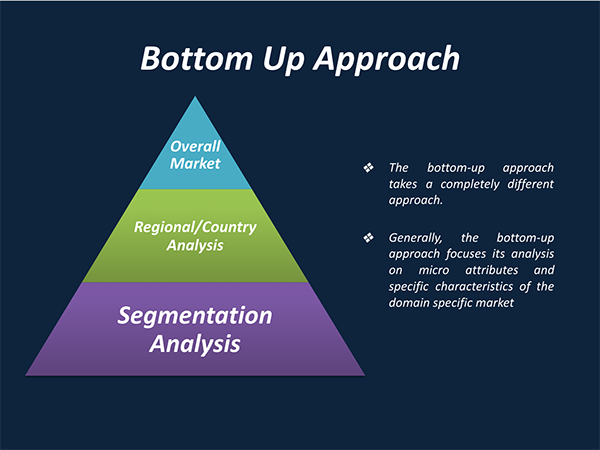

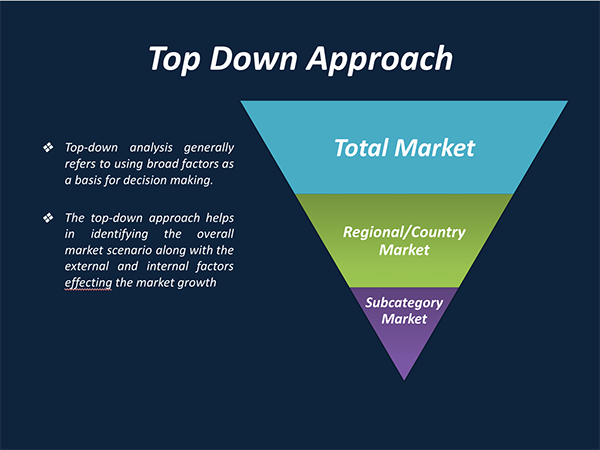

Our research report features both the aspects; qualitative and quantitative. Qualitative part provides insights about the market driving forces, potential opportunities, customer’s demands and requirement which in turn help the companies to come up with new strategies in order to survive in the long run competition. The quantitative segment offers the most credible information related to the industry. Based on the data gathering, we use to derive the market size and estimate their future growth prospects on the basis of global, region and country.

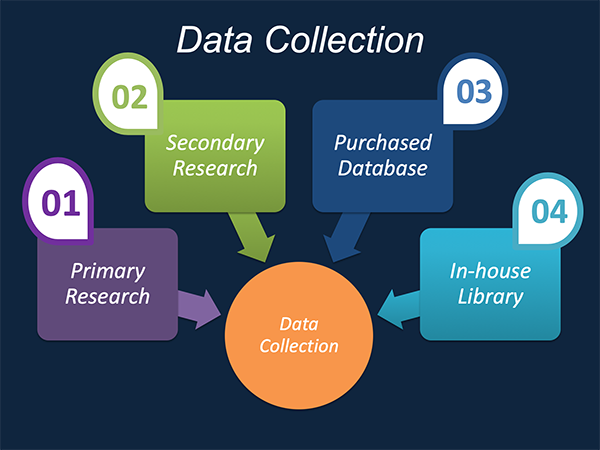

Our market research process involves with the four specific stages.

Data Collection: This stage of the market research process involves with the gathering and collecting of the market/industry related data from the sources. There are basically two types of research methods:

Data Synthesis: This stage includes the evaluation and assessment of all the data acquired from the primary and secondary research. It likewise includes in evaluating the information for any disparity watched while information gathering identified with the market. The data & information is gathered with consideration to the heterogeneity of sources. Scientific and statistical methods are implemented for synthesizing dissimilar information sets and provide the relevant data which is fundamental for formulating strategies. Our organization has broad involvement with information amalgamation where the information goes through different stages:

Market Formulation & Deduction: The last stage includes assigning the data & information in a suitable way in order to derive market size. Analyst reviews and domain based opinions based on holistic approach of market estimation combined with industry investigation additionally features a crucial role in this stage.

This stage includes with the finalization of the market size and numbers that we have gathered from primary and secondary research. With the data & information addition, we ensure that there is no gap in the market information. Market trend analysis is finished by our analysts by utilizing data extrapolation procedures, which give the most ideal figures to the market.

Data Validation: Validation is the most crucial step in the process. Validation & re-validation through scientifically designed technique and process that helps us finalize data-points to be used for final calculations. This stage also involves with the data triangulation process. Data triangulation generally implicates the cross validation and matching the data which has been collected from primary and secondary research methods.

Free Customization

Countries can be added on demand

Free yearly update on purchase of Multi/Corporate User License

Companies served till date

We serve our customers 24x7 for 365 days through calls, emails and live chat options.

Huge database of exceptional market reports bringing market intelligence to your fingertips.

SSL enabled, we offer you various secured payment options for risk free purchase.